What is a Kansas Bill of Sale form?

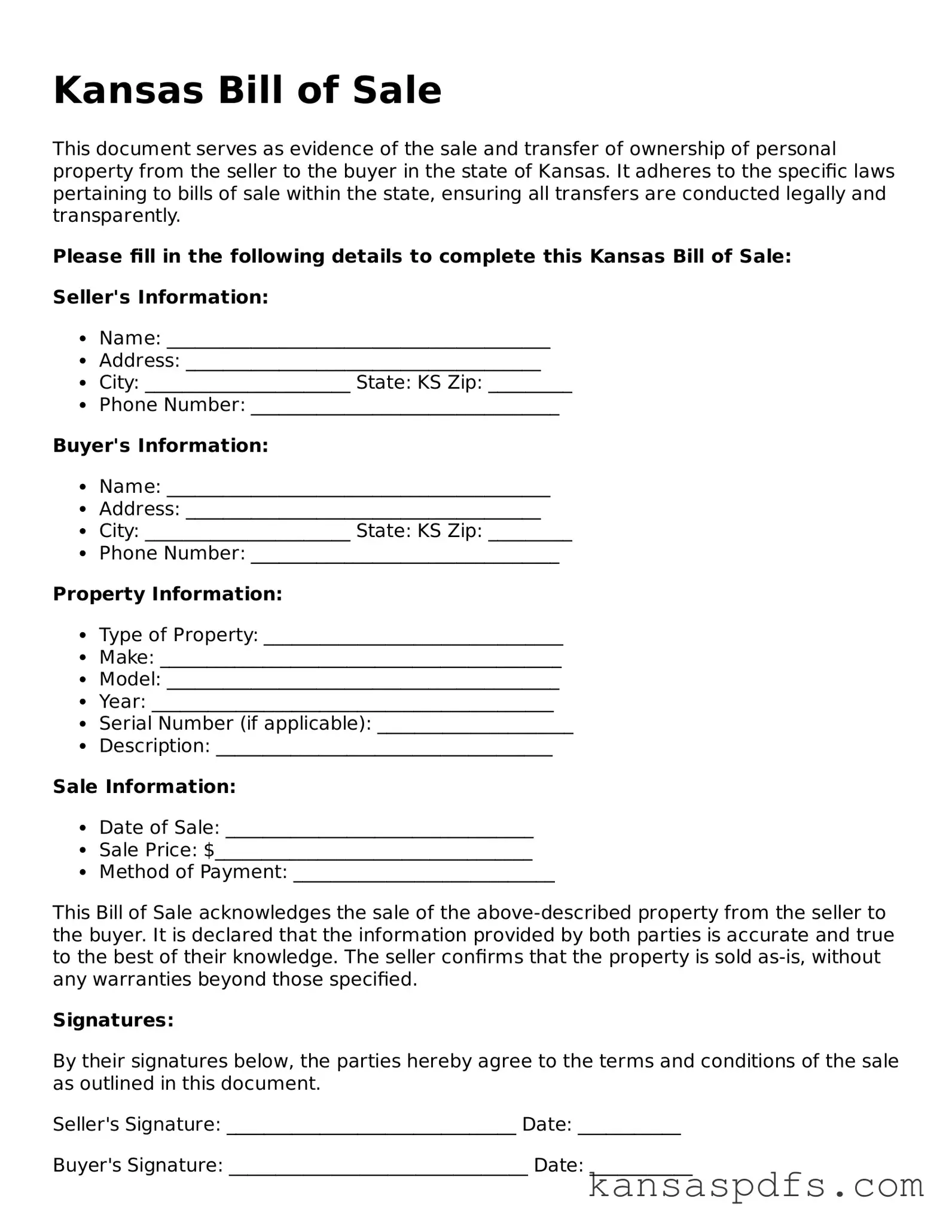

A Kansas Bill of Sale form is a legal document used to record the sale of any item, typically vehicles or personal property, between a seller and a buyer in the state of Kansas. It confirms that ownership of the item has been transferred from the seller to the buyer.

Why is it necessary to use a Bill of Sale in Kansas?

Using a Bill of Sale in Kansas is necessary for several reasons. It provides legal proof of the sale and transfer of ownership. For vehicles, it is often required for registration and tax purposes. Additionally, it protects both the seller and the buyer in case disputes arise after the transaction.

What information is typically included in a Kansas Bill of Sale?

A Kansas Bill of Sale typically includes the name and address of both the seller and the buyer, a detailed description of the item sold (including make, model, year, and VIN for vehicles), the sale price, the date of sale, and the signatures of both parties involved.

Do both parties need to sign the Kansas Bill of Sale?

Yes, both the seller and the buyer are required to sign the Kansas Bill of Sale. Their signatures serve as confirmation of the transaction and agreement to the terms of the sale. It's also recommended to have the signatures notarized for added legal protection.

Is a Kansas Bill of Sale required for all types of property?

No, a Kansas Bill of Sale is not required for all types of property. It is most commonly used for the sale of vehicles and large personal items. However, it's a good idea to use one for the sale of any significant property for record-keeping and legal protection.

Does a Bill of Sale need to be notarized in Kansas?

While notarization is not required by Kansas law for a Bill of Sale to be considered valid, it is highly recommended. Notarization adds an extra layer of legal protection by verifying the identity of the signatories and the authenticity of the document.

How does one obtain a Kansas Bill of Sale form?

A Kansas Bill of Sale form can be obtained through various means. It can be downloaded from legal and government websites, purchased from office supply stores, or drafted by legal professionals. Ensure the form complies with Kansas state requirements.

Can a Kansas Bill of Sale be used as a legal document in court?

Yes, a Kansas Bill of Sale can be used as a legal document in court. It serves as evidence of the sale and transfer of ownership. Its effectiveness in court often depends on its accuracy, completeness, and whether it was signed and possibly notarized.

What happens if a Bill of Sale is not used in a transaction in Kansas?

If a Bill of Sale is not used in a transaction, proving ownership and the details of the transaction may become more complicated, especially in disputes or for tax and registration purposes. It might also increase vulnerability to fraud and misunderstandings between the seller and the buyer.

Are there any penalties for not using a Bill of Sale for relevant transactions in Kansas?

There aren't specific penalties for not using a Bill of Sale in Kansas, but failing to document a transaction properly can lead to difficulties in proving ownership, resolving disputes, and fulfilling tax and registration requirements. Using a Bill of Sale is strongly advised to avoid these potential issues.