What is a Kansas Deed form?

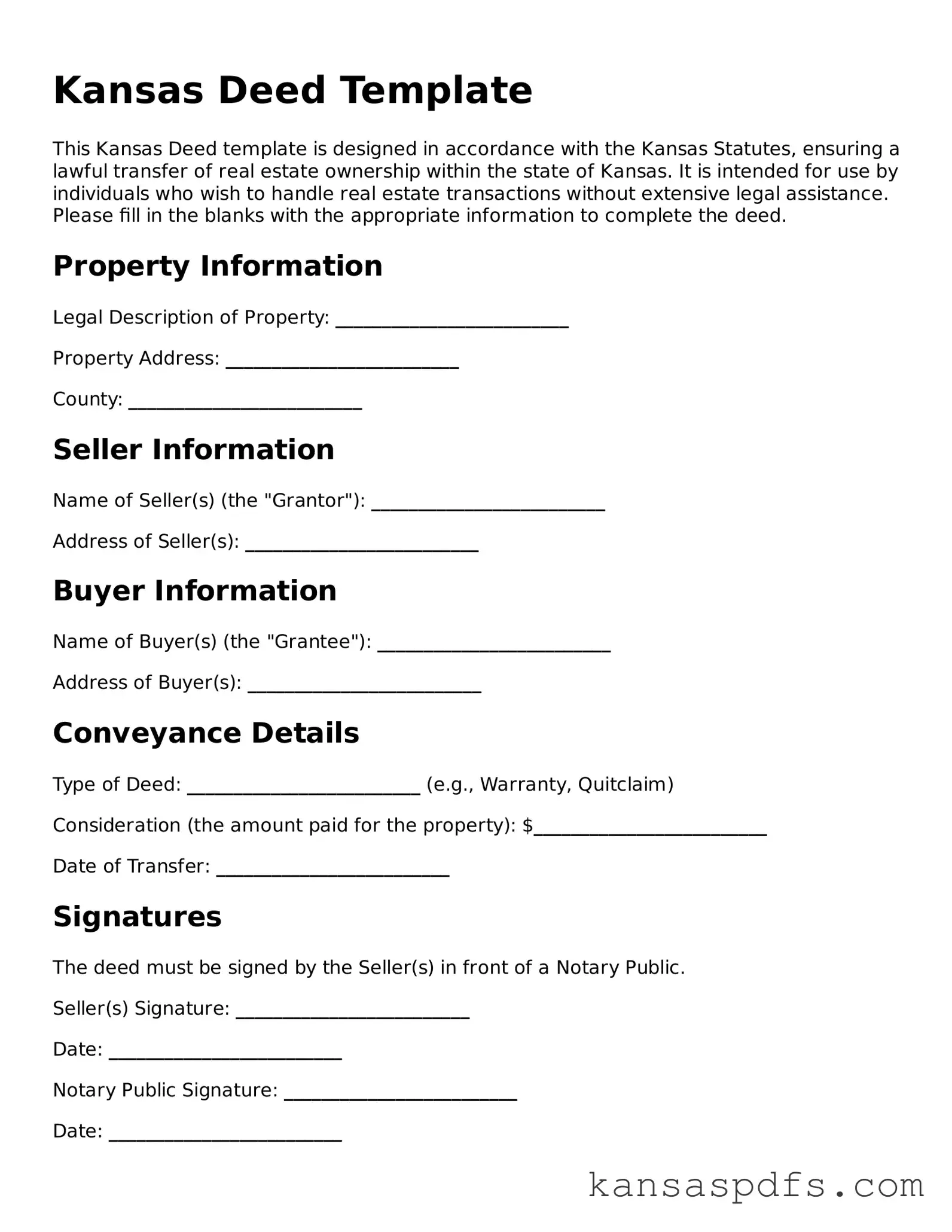

A Kansas Deet form is a legal document used to transfer property ownership from one person (the grantor) to another (the grantee) in the state of Kansas. It must include specific information to be legally valid, such as a description of the property, the names of the buyer and seller, and it must be signed by the grantor.

What types of Deed forms are used in Kansas?

In Kansas, several types of Deed forms are used, including Warranty Deeds, which provide the buyer with the highest level of protection; Quitclaim Deeds, which transfer only the interest the grantor has in the property without any warranties; and Special Warranty Deeds, which only warrant against the grantor's actions.

Are there any special requirements for executing a Deed in Kansas?

Yes, Kansas law requires that all Deed forms must be signed by the grantor in the presence of a notary public. Additionally, specific information about the grantee and the legal description of the property must be accurately provided. The Deed then needs to be filed with the county's Register of Deeds where the property is located.

Is a lawyer required to create a Deed in Kansas?

While a lawyer is not strictly required to create a Deed in Kansas, consulting with one is highly recommended. A lawyer can ensure that the Deed complies with Kansas law and adequately protects all parties' interests in the transaction.

How does one file a Deed form in Kansas?

After obtaining the required signatures and notarization, a Deed must be filed with the Register of Deeds in the Kansas county where the property is located. This process typically involves submitting the original signed Deed along with any necessary filing fees. It's important to verify specific filing requirements and fees with the local Register of Deeds office.

What happens if a Deed is not filed in Kansas?

If a Deed is not filed with the appropriate county in Kansas, the transfer of property ownership may not be legally recognized. This can lead to potential legal disputes and complications with property rights in the future. Therefore, it's crucial to file the Deed properly to ensure the legal transfer of ownership.

Can a Kansas Deed be revoked once it's filed?

Once a Deed is filed in Kansas, it cannot be revoked unilaterally. Any changes or revocations to the property transfer require agreement from both the grantor and grantee and may necessitate the execution and filing of a new Deed or other legal documents.

Does Kansas require a property to be inspected before transferring ownership?

Kansas does not mandate a property inspection before transferring ownership. However, buyers often opt for an inspection to understand the property's condition before purchase. While it's not a legal requirement, it is a wise precaution.

What is the difference between a Warranty Deed and a Quitclaim Deed in Kansas?

The main difference lies in the level of protection for the buyer. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it, offering protections against any title defects. A Quitclaim Deed, on the other hand, transfers only the interest the seller has in the property, if any, without any warranties regarding clear title or the existence of encumbrances.

How can someone verify that a Deed has been successfully filed in Kansas?

To verify that a Deed has been successfully filed in Kansas, one can contact the Register of Deeds office in the county where the property is located. Most counties offer the option to search records online, but it's also possible to request verification in person or by phone. Ensure to have the property's legal description and the names of the parties involved in the transaction for a seamless verification process.