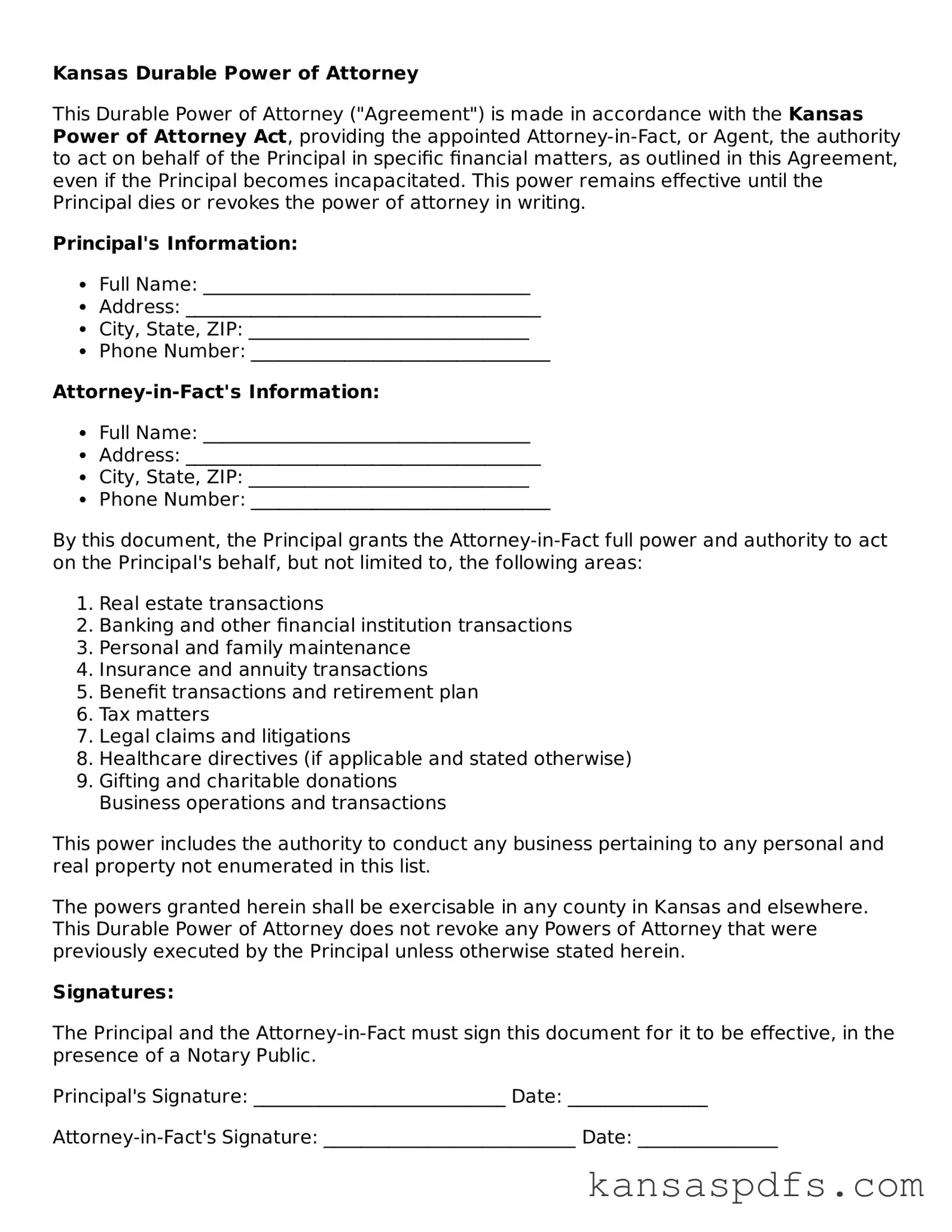

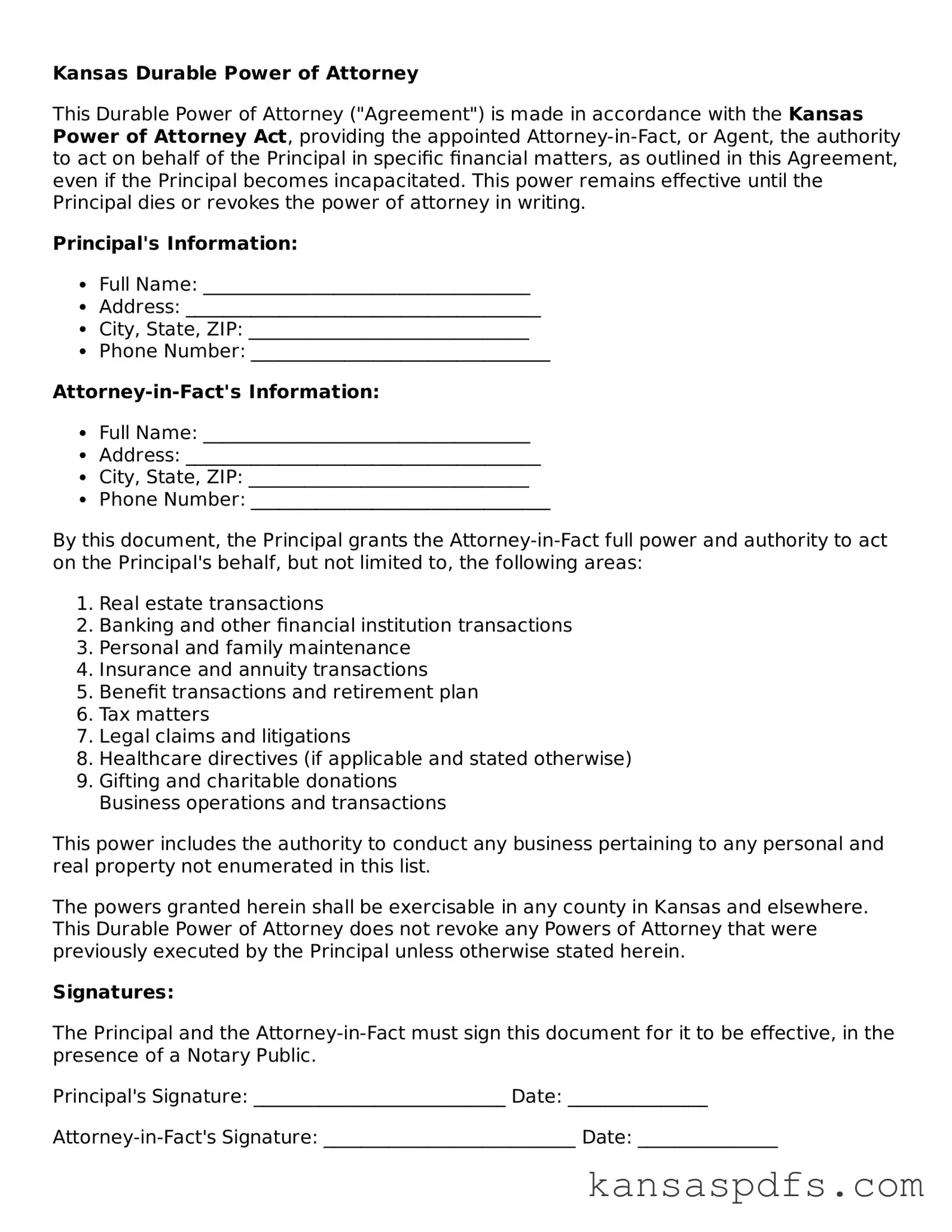

Blank Kansas Durable Power of Attorney Document

The Kansas Durable Power of Attorney form is a legal document that allows someone to make decisions on your behalf, especially during times when you're unable to do so yourself. It's designed to be effective even if you become incapacitated, ensuring your affairs can be managed according to your wishes. For those interested in securing their future decision-making, filling out this form could be the next step—click the button below to get started.

Get My Form Now

Blank Kansas Durable Power of Attorney Document

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Durable Power of Attorney online with quick edits and instant download.