Kansas Al 30 PDF Form

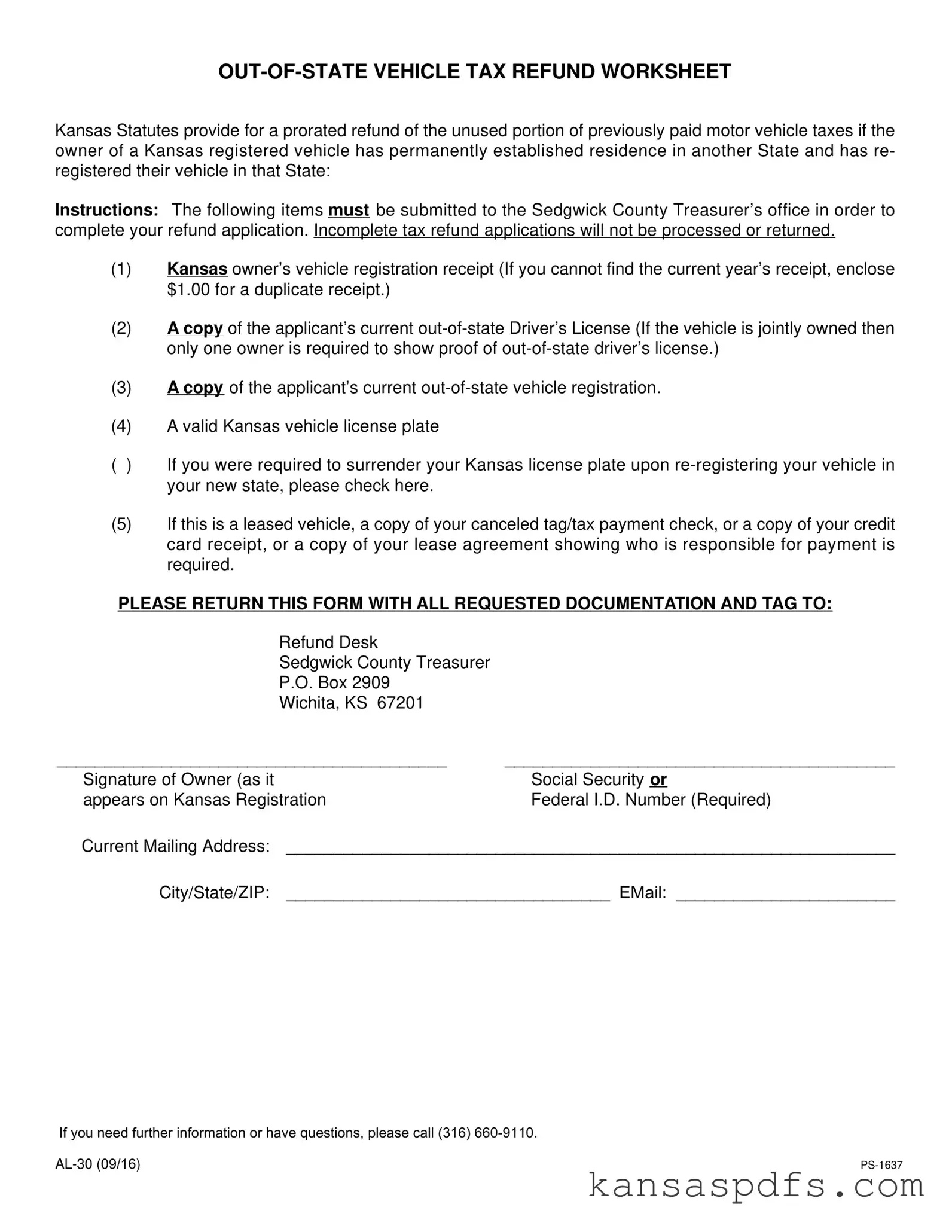

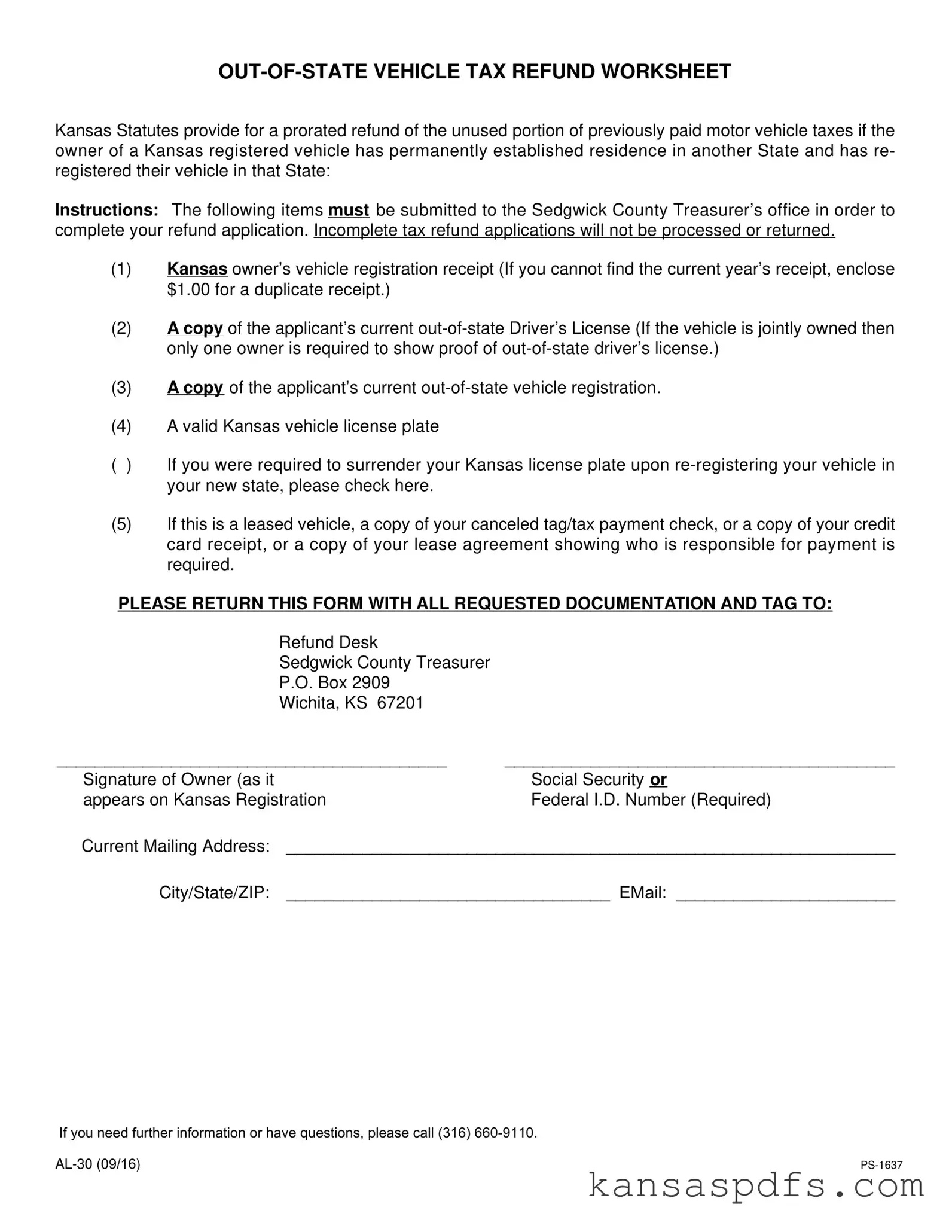

The Kansas AL-30 form is a document designed for Kansas registered vehicle owners who have moved out-of-state and want to apply for a prorated refund of the unused portion of their motor vehicle taxes. It outlines the requirements for obtaining a refund, including submission of specific documents to the Sedgwick County Treasurer’s office. To ensure a smooth process, it's important to complete the application thoroughly and provide all requested documentation.

If you're ready to apply for your tax refund, click the button below to get started.

Get My Form Now

Kansas Al 30 PDF Form

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Kansas Al 30 online with quick edits and instant download.