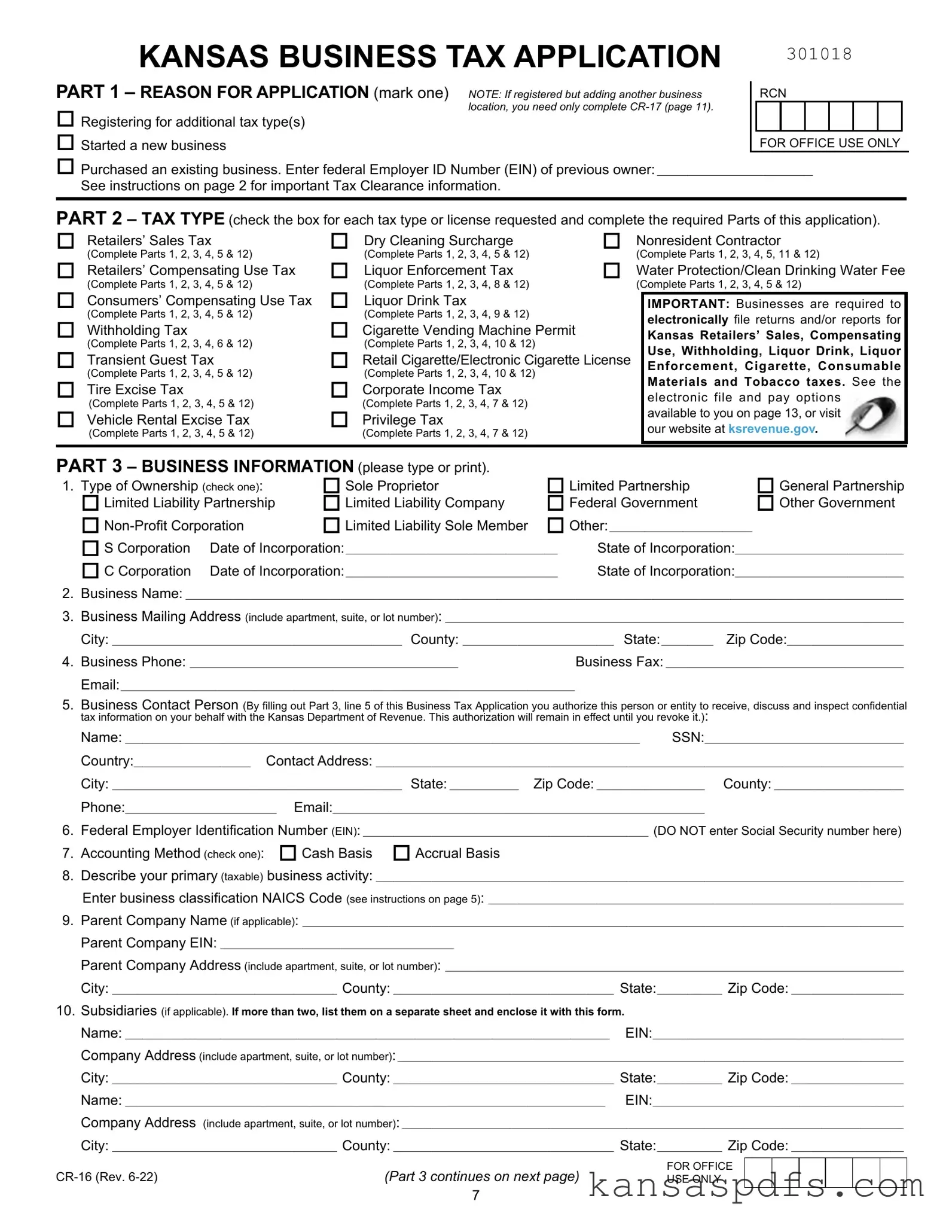

|

|

301118 |

ENTER YOUR EIN:_____________________________________________________ |

OR |

SSN: _______________________________________________________ |

|

|

|

|

|

|

PART 3 – (CONTINUED)

11. Have you or any member of your firm previously held a Kansas tax registration number?No Yes If yes, list previous number or

name of business:______________________________________________________________________________________________________________________________________________________________________

12.List all Kansas registration numbers currently in use:_____________________________________________________________________________________________________________________

13.List all registration numbers that need to be closed due to the filing of this application:______________________________________________________________________

________________________________________________________________________________________________________________________________________________________________________________________________

14. Are you registered with Streamlined Sales Tax (SST)? No Yes If yes, enter SST ID #: S_____________________________________

PART 4 – LOCATION INFORMATION (If you have only one business location, complete Part 4. If you have more than one location, complete Part 4 and form CR-17 for each additional location. This form is on page 11).

1.Trade name of business: _____________________________________________________________________________________________________________________________________________________________

2.Business Location (include apartment, suite, or lot number): ___________________________________________________________________________________________________________

City: _____________________________________________________ County: _________________________________________________ State:______________ Zip Code: __________________________

3. Is the business location within the city limits?

4.Describe your primary business activity: _______________________________________________________________________________________________________________________________________

Enter business classification NAICS Code (see instructions on page 5):___________________________________________________________________________________________

5.Business phone number:________________________________________________

6.Is your business engaged in renting or leasing motor vehicles? Yes No Are the leases for more than 28 days? Yes No

7. |

Is this location a hotel, motel, or bed and breakfast? No Yes If yes, number of sleeping rooms available for rent/lease: _____________ |

|

If 3 rooms or less, do you have retail sales or rentals other than those included in the price of the sleeping accommodations? Yes No |

8. |

Do you sell new tires and/or vehicles with new tires? Yes |

No |

Estimate your monthly tire tax ($.25 per tire): $ ____________________ |

9. |

If you are a dry cleaner or laundry retailer, do you have satellite locations or agents in businesses not classified as a dry cleaning or laundry |

|

facility? No Yes If yes, enclose a schedule with name, business type, address, city, state, and zip code of each satellite location. |

10. Are you a public water supplier making retail sales of water delivered through mains, lines, or pipes? Yes No |

11. Do you make retail sales of motor vehicle fuels or special fuels? No Yes |

If yes, you must also have a Kansas Motor Fuel |

|

Retailers License. Complete and submit application form MF-53 for each retail location. |

|

|

|

PART 5 – SALES TAX AND COMPENSATING USE TAX |

|

|

1. |

Date retail sales/compensating use began (or will begin) in Kansas under this ownership: _____________________________________ |

2. |

Do you operate more than one business location in Kansas? |

No |

Yes |

If yes, how many? _________ (Complete a form CR-17 |

(page 11)) for each location in addition to the one listed in PART 4. Sales for all locations are reported on one return.)

|

|

|

|

|

3. |

Will sales be made from various temporary locations? Yes |

No |

4. |

Do you ship or deliver merchandise to Kansas customers? Yes |

No |

5. |

Do you purchase merchandise, equipment, fixtures, and other items outside Kansas for your own use (not for resale) in Kansas on |

|

which you are not charged a sales tax? Yes No |

|

|

6. |

Estimate your annual Kansas sales or compensating use tax liability: |

|

|

$400 and under (annual filer) |

$401 - $4,000 (quarterly filer) |

$4,001 and more (monthly filer) |

7.If your business is seasonal, list the months you operate: _______________________________________________________________________________________________________________

8.Do you perform labor services in connection with the construction, reconstruction, or repair of commercial buildings or facilities?

Yes No

9. Do you sell natural gas, electricity, or heat (propane gas, LP gas, coal, wood) to residential or agricultural customers? Yes No

10. |

Are you a remote seller? (See instructions) Yes |

No |

11. |

Are you a marketplace facilitator? (See instructions) |

Yes No |

12. As a marketplace facilitator, do you wish to report your retailer's compensating use tax collected from direct sales made by you separately

from the tax you collected from sales you facilitated on behalf of marketplace sellers? |

Yes |

No |