What is the CT-9U form used for in Kansas?

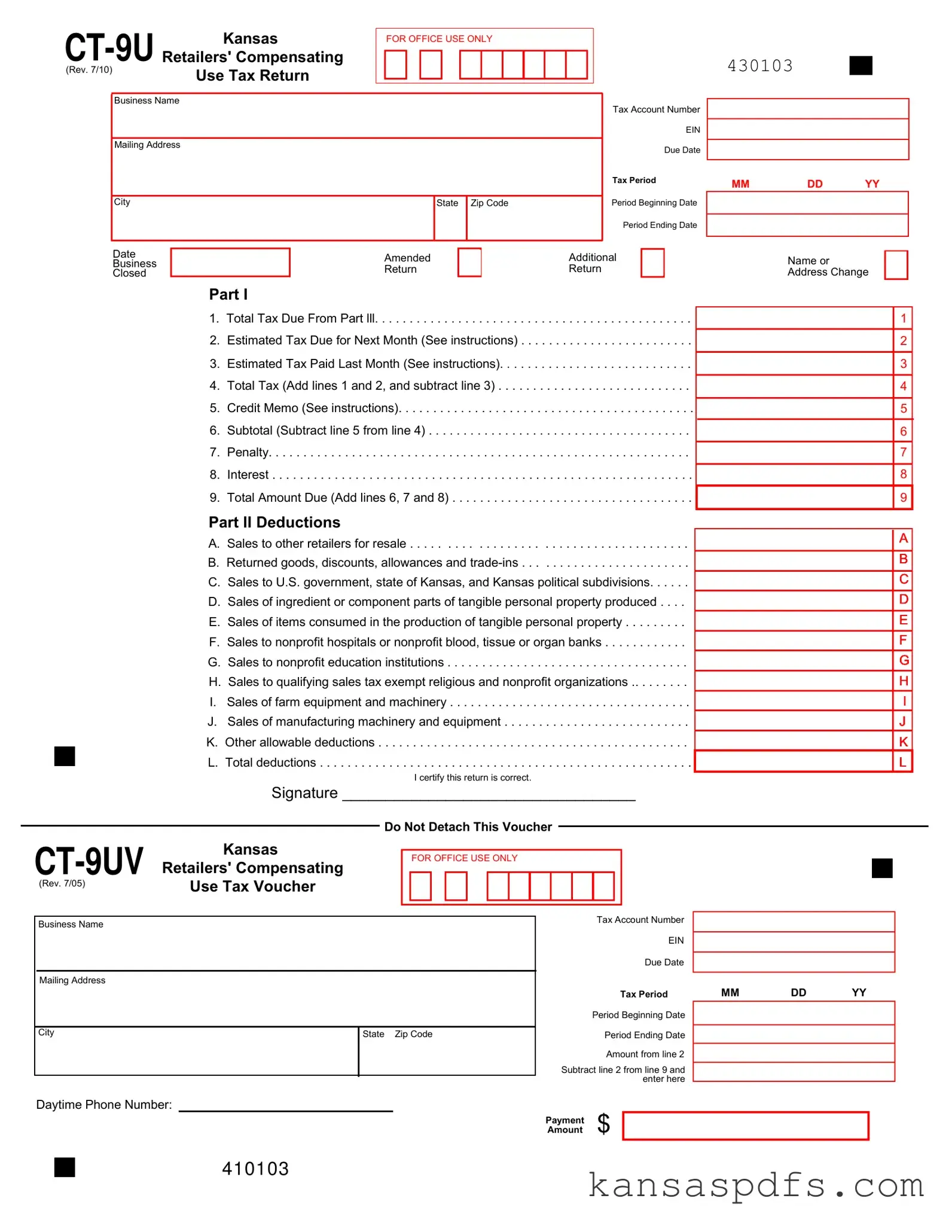

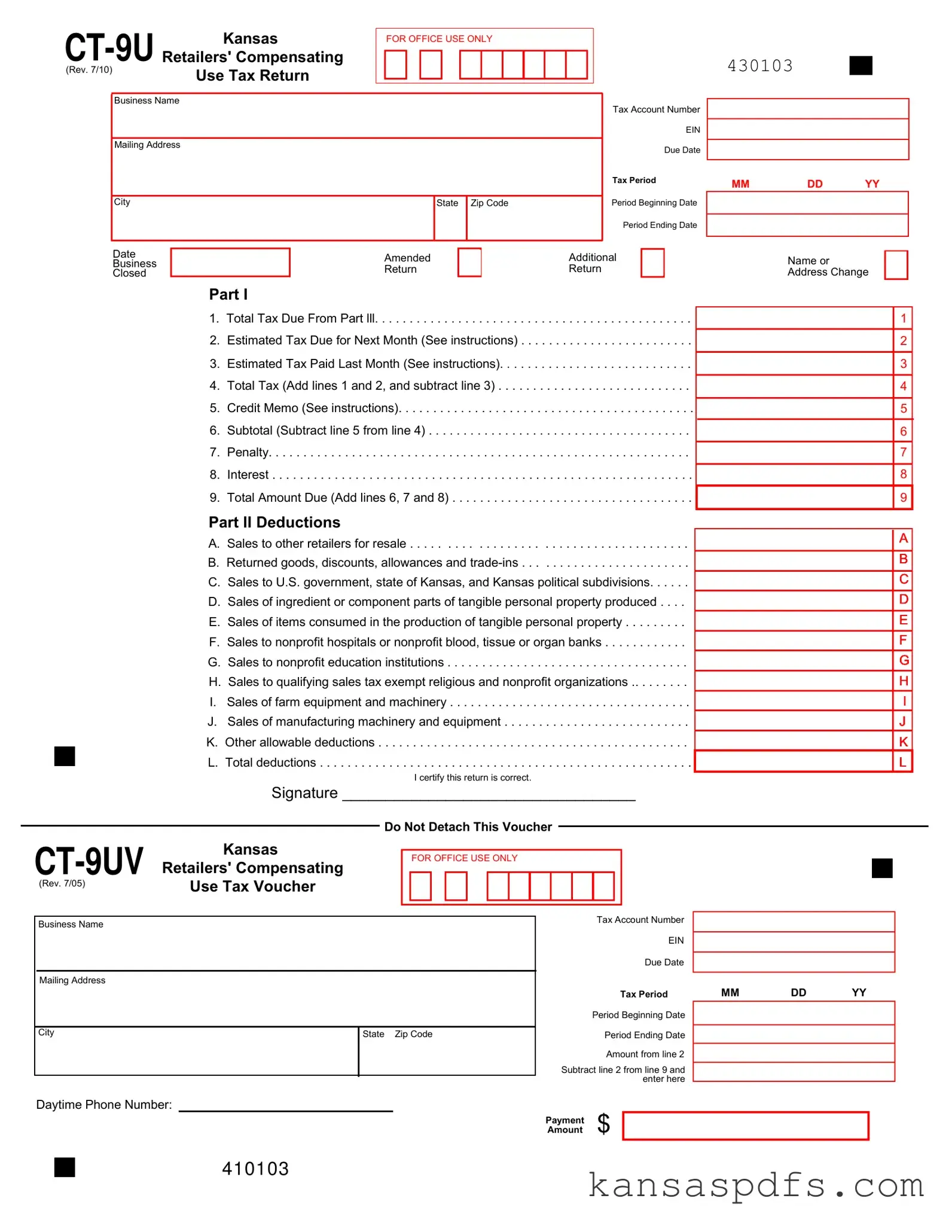

The CT-9U form is utilized by retailers in Kansas to report and pay compensating use tax. This tax is due on purchases made from out-of-state or online where Kansas sales tax has not been paid. It applies to items for use, storage, or consumption within Kansas. Retailers must complete this form to comply with tax regulations, ensuring they pay the correct amount of use tax to the Kansas Department of Revenue.

Who needs to file the CT-9U form?

Retailers operating in Kansas and making purchases from out-of-state suppliers, where sales tax was not collected at the point of sale, are required to file the CT-9U form. This requirement applies to both tangible personal property and certain services that are used, stored, or consumed in Kansas which are subject to use tax.

When is the CT-9U form due?

The due date for the CT-9U form is the 25th day of the month following the tax period's closure. For example, for purchases made in January, the form and payment are due by February 25th. Timely submission is crucial to avoid penalties and interest for late filings.

How do I calculate the amount of tax due on the CT-9U form?

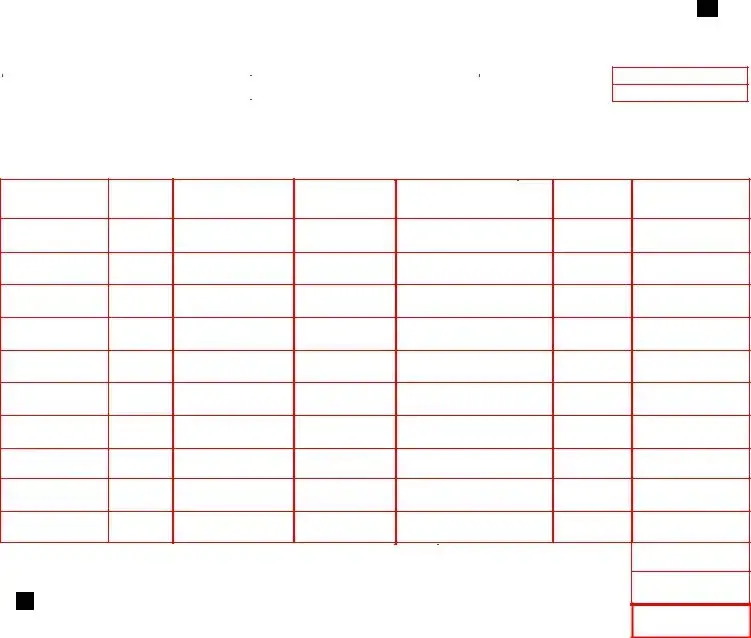

Calculate the tax due by completing Part III of the form to document gross sales and allowable deductions. Next, in Part I, calculate the total tax by adding the tax from Part III (line 1), the estimated tax due for the next month (line 2), then subtract any estimated tax paid last month (line 3). Adjustments for credit memos, penalties, and interest are made to arrive at the total amount due, recorded on line 9, Part I.

Can I file the CT-9U form and make payments online?

Yes, the Kansas Department of Revenue encourages retailers to file the CT-9U form and make payments online via KS WebTax. This platform simplifies the filing process, reduces paper use, and ensures faster processing of payments and returns.

What penalties are applied for late filing or payment of the CT-9U form?

Penalties for late filing or payment of the CT-9U form are assessed based on the amount due and the delay's length. The Kansas Department of Revenue's website provides detailed information on penalty rates. Retailers are encouraged to file and pay on time to avoid these additional charges.

Where do I send my completed CT-9U form if I am not filing online?

If you choose not to file online, completed CT-9U forms along with any payment due should be mailed to the Kansas Department of Revenue at 915 SW Harrison Street, Topeka, KS 66625-5000. Ensure that your Tax Account Number is written on your check or money order, and remember to keep a copy of the form for your records.