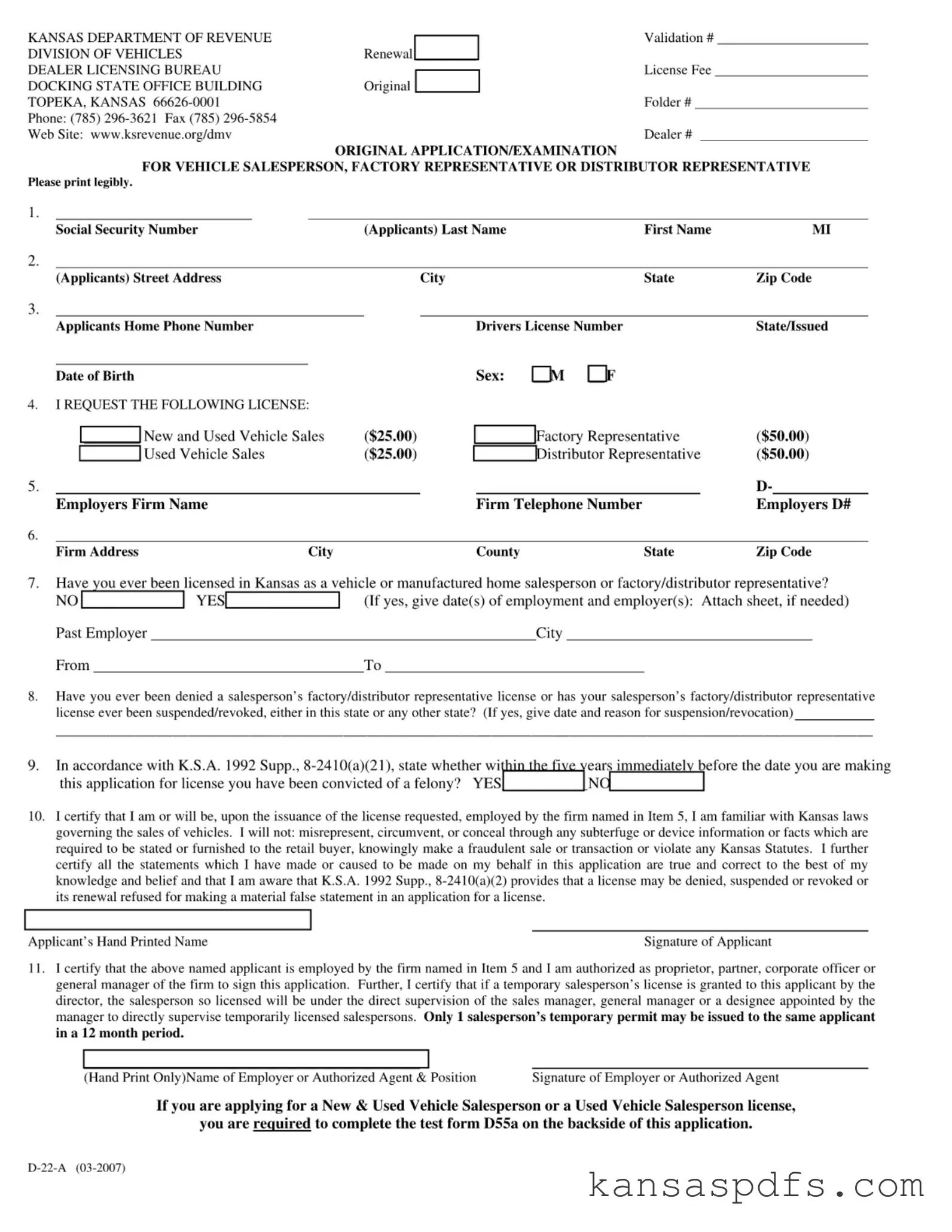

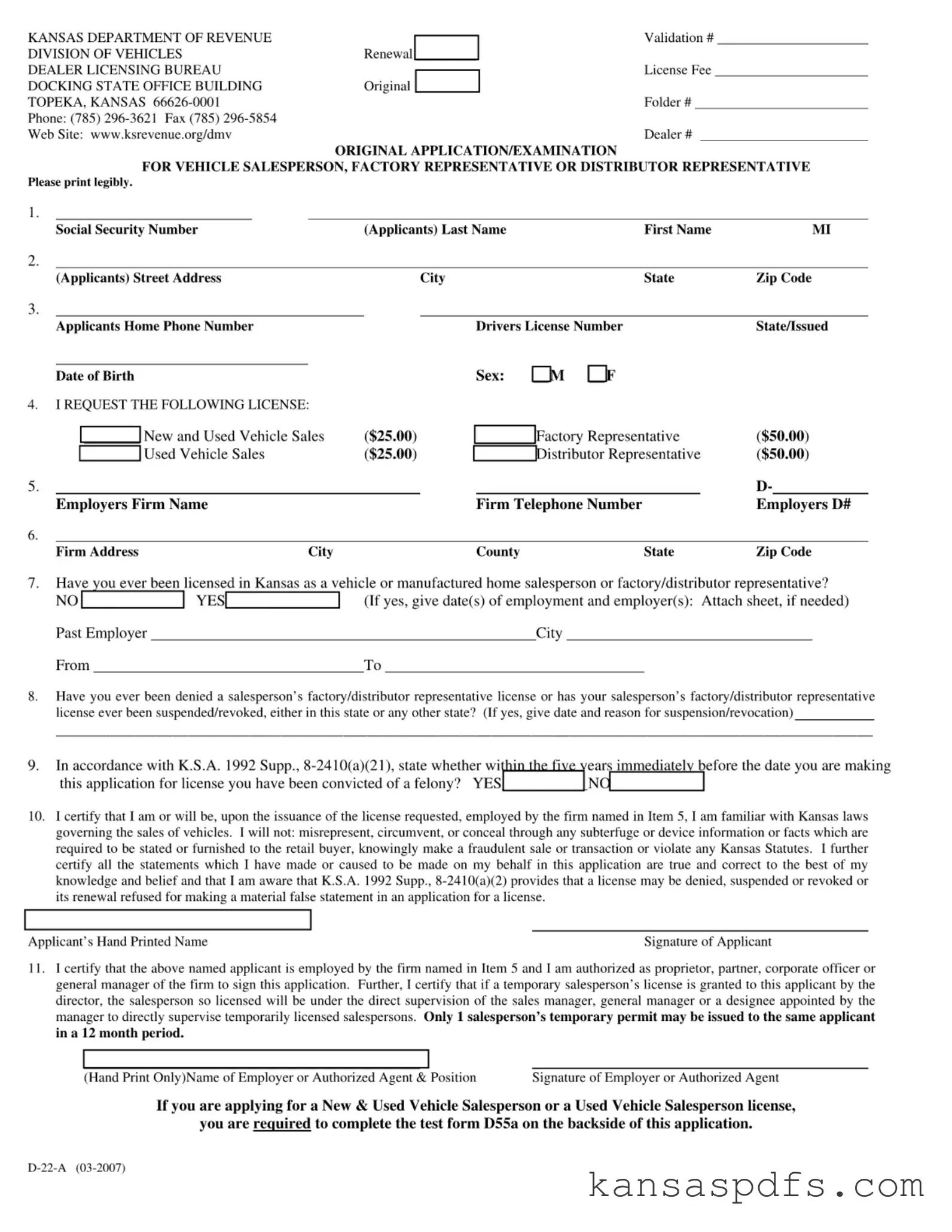

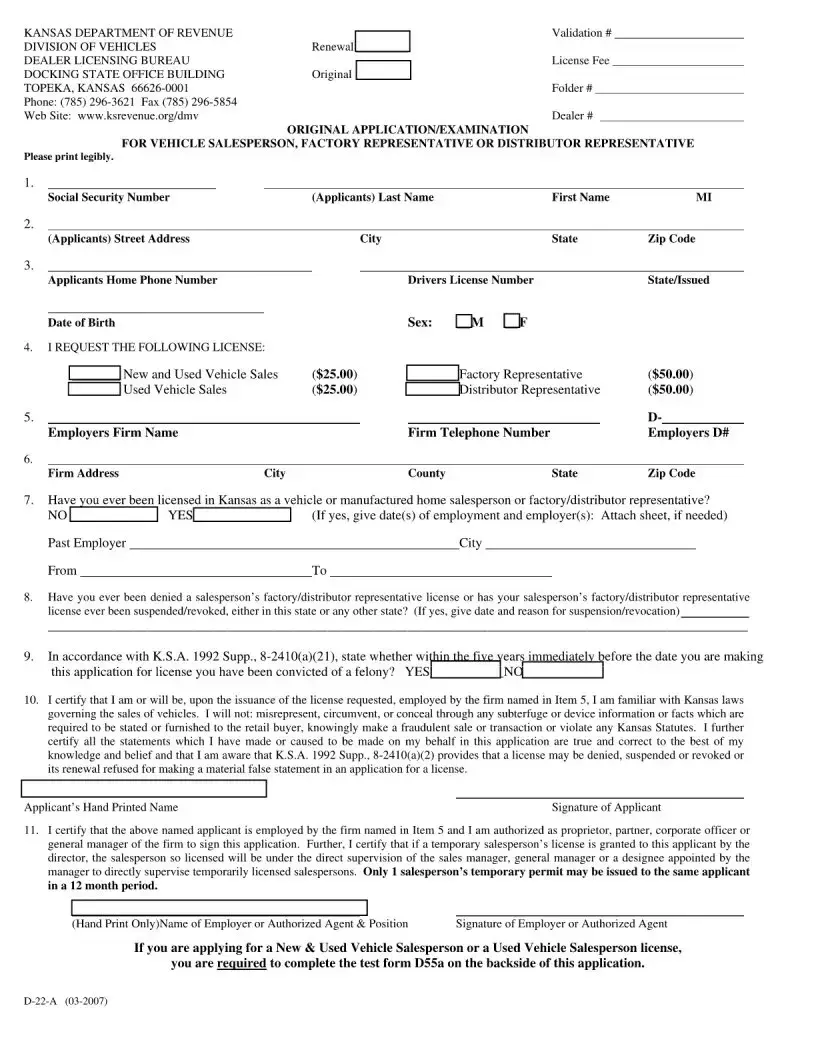

What is the Kansas D 22A form?

The Kansas D 22A form, officially known as the Kansas Workers Compensation K-WC 22-A-A (Rev. 11-11) Affidavit of Exempt Status Under the Workers Compensation Act, is a document used by certain individuals or entities to affirm their exempt status from workers' compensation insurance coverage requirements under the Kansas Workers Compensation Act.

Who needs to fill out the Kansas D 22A form?

This form is typically filled out by sole proprietors, partners, or executive officers of a corporation who wish to claim exemption from carrying workers' compensation insurance. It's important for these individuals to verify whether they meet the criteria for exemption as outlined by Kansas law.

How do I know if I am eligible for exemption under the Kansas Workers Compensation Act?

Eligibility for exemption depends on your status as a sole proprietor, partner, or an executive officer of a corporation and not being mandated by Kansas law to have workers' compensation coverage. The specifics can vary, so it is advisable to review the Kansas Workers Compensation Act or consult with a legal professional to determine eligibility.

Where can I obtain the Kansas D 22A form?

The Kansas D 22A form can be downloaded from the official website of the Kansas Department of Labor. It may also be available through legal advisers or workers' compensation specialists who can provide guidance on how to properly complete and submit the form.

What information is needed to complete the form?

Completing the Kansas D 22A form requires personal information including your name, business name, address, and a detailed statement affirming your exempt status. Additionally, you'll need to provide a justification for the exemption and sign the affidavit in front of a notary public.

Is notarization required for the Kansas D 22A form?

Yes, the Kansas D 22A form must be signed in the presence of a notary public. The notarization process is crucial as it officially verifies your identity and the veracity of your affirmation of exempt status.

After filling out the form, where should it be submitted?

Once completed and notarized, the Kansas D 22A form should be submitted to the Kansas Division of Workers Compensation. The specific mailing address or electronic submission details can be found on the Kansas Department of Labor's website or by contacting them directly.

What are the consequences of not submitting the form?

Failure to submit the Kansas D 22A form if you claim exemption can lead to various complications, including but not limited to, being deemed non-compliant with Kansas Workers Compensation laws. This non-compliance could result in fines, penalties, or being required to obtain workers' compensation insurance retroactively.