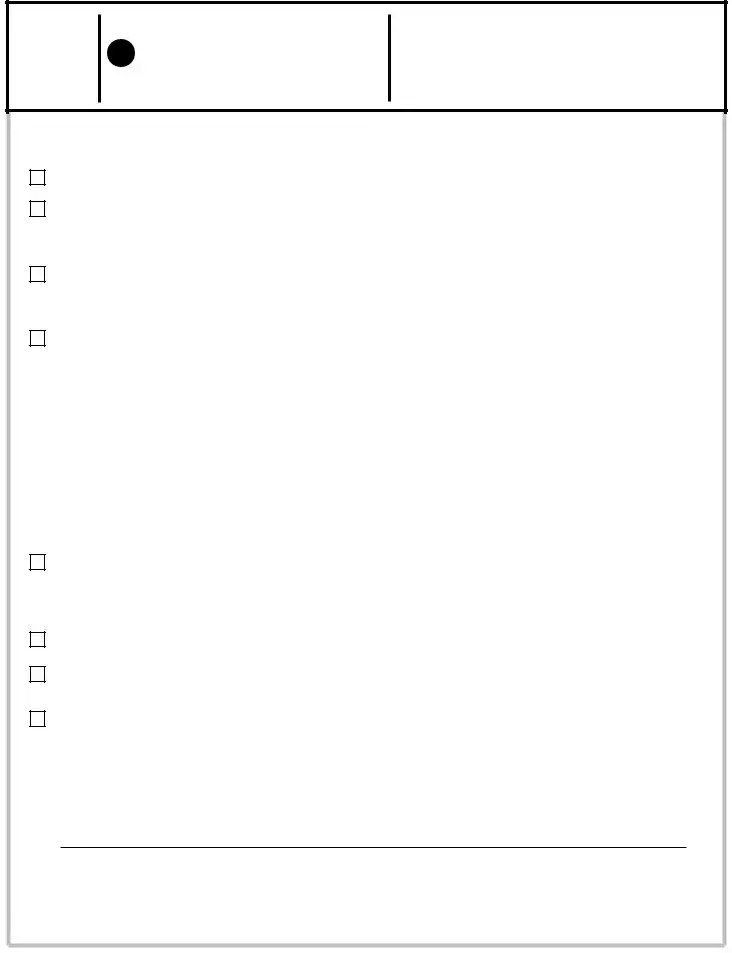

Kansas Fa 51 03 PDF Form

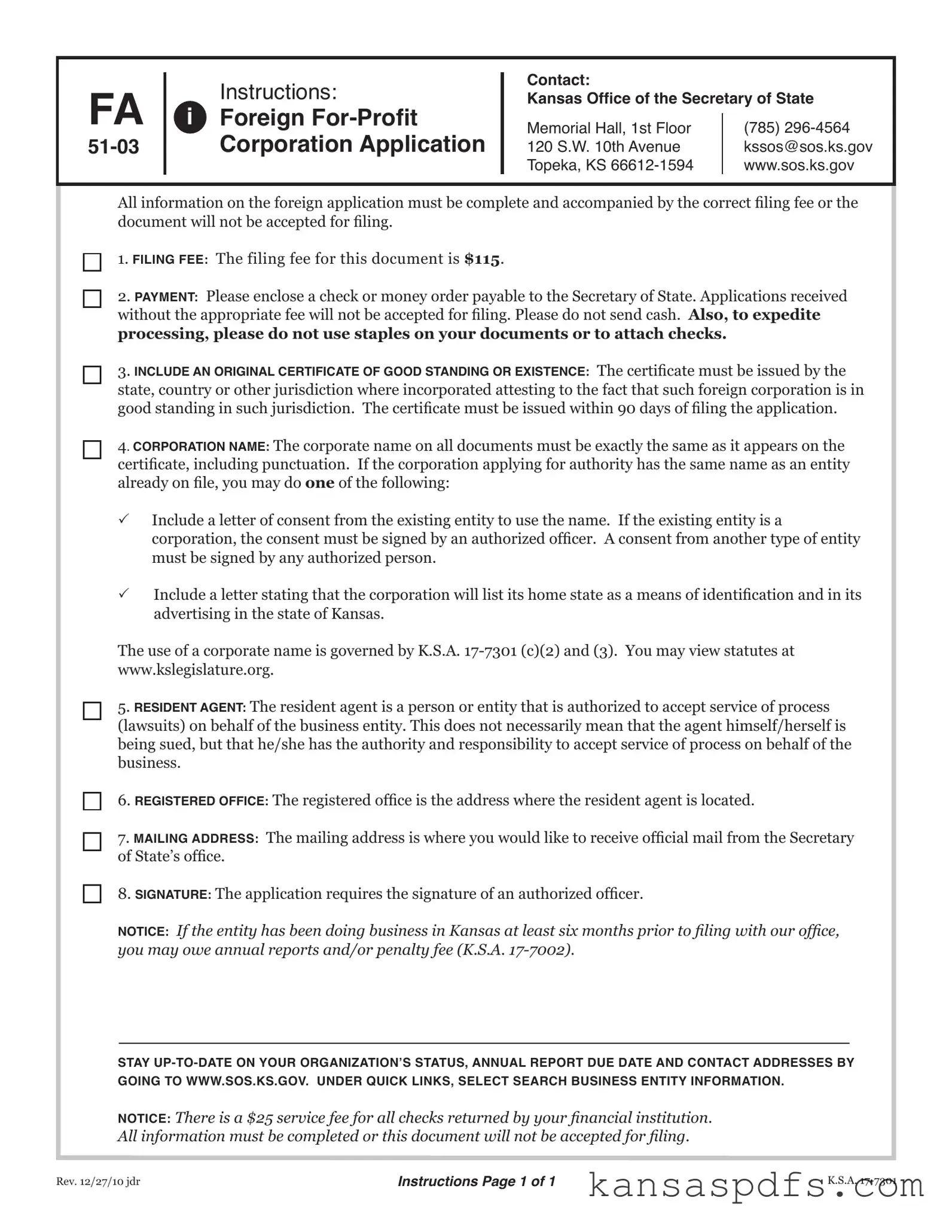

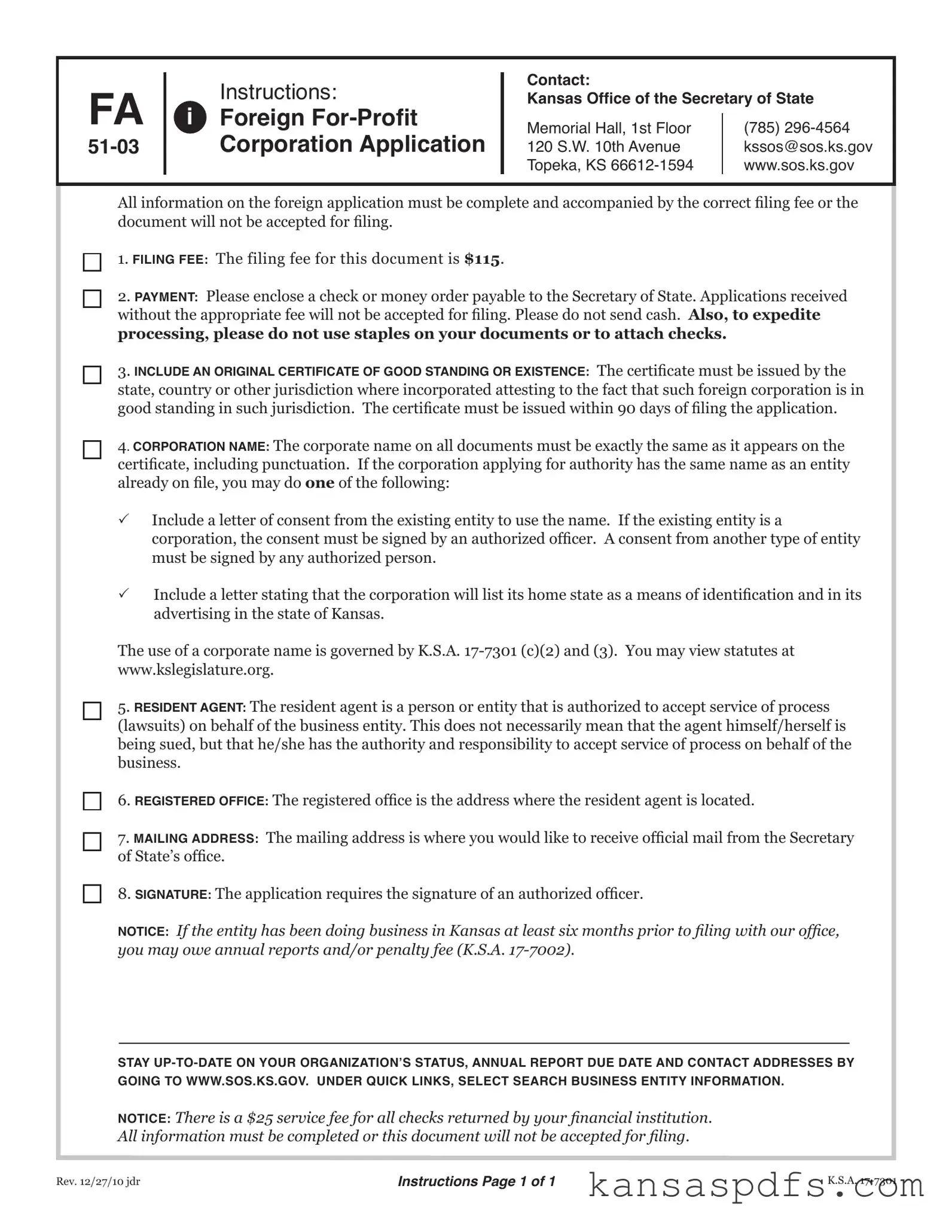

The Kansas FA 51-03 form is a necessary document for foreign for-profit corporations seeking to do business in Kansas. It serves as an application for these corporations to register with the Kansas Office of the Secretary of State, requiring details such as the corporation's name, the state or country of organization, and a registered agent in Kansas among other specifics. Completing and submitting this form with the appropriate filing fee is crucial for compliance and legal operation within the state. To ensure you complete the form accurately and understand all requirements, click the button below.

Get My Form Now

Kansas Fa 51 03 PDF Form

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Kansas Fa 51 03 online with quick edits and instant download.