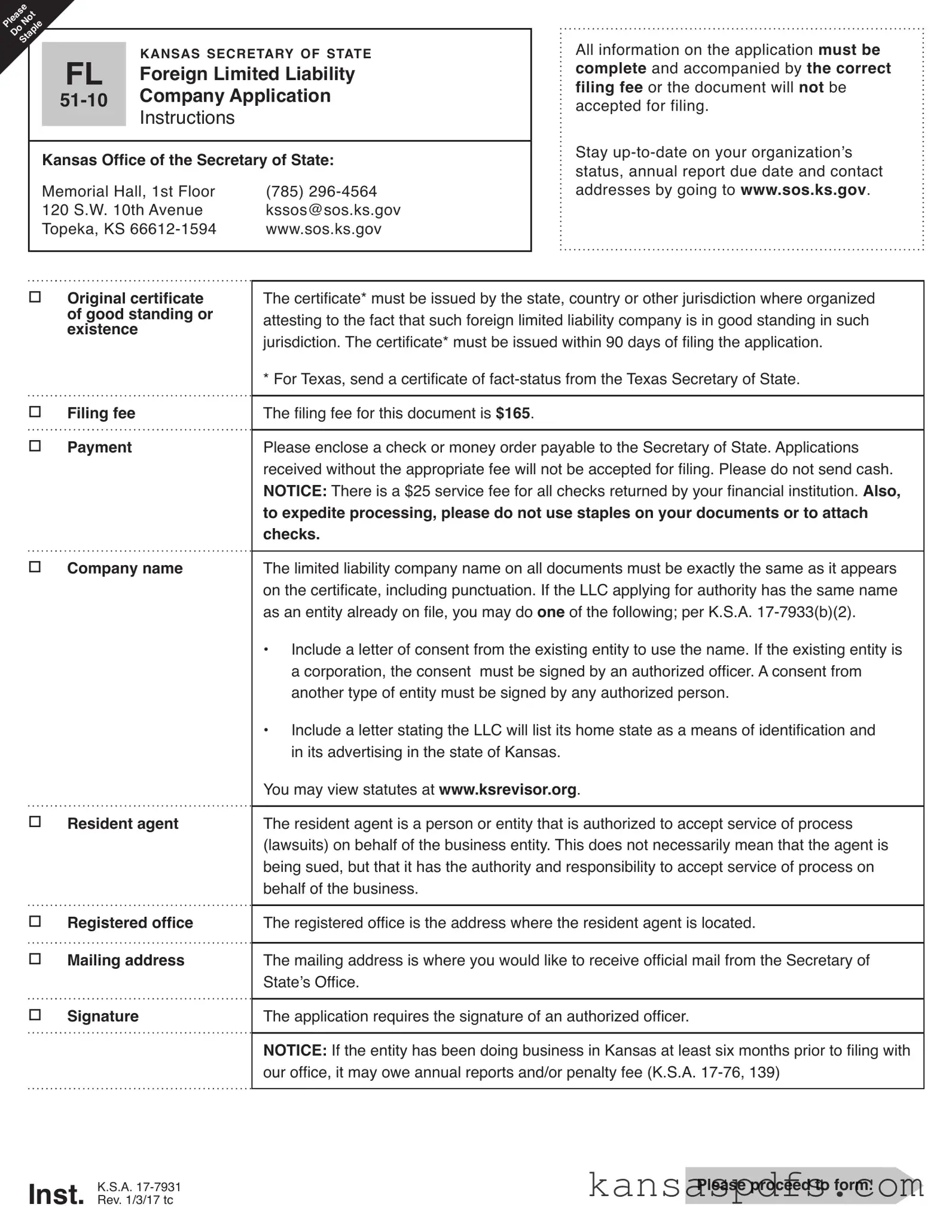

What is the Kansas FL 51-10 form?

The Kansas FL 51-10 form is an application used by foreign limited liability companies (LLCs) to register to do business in Kansas. It requires information about the LLC, including its name, state or country of organization, and a certificate of good standing from its home jurisdiction.

Who needs to file the Kansas FL 51-10 form?

Any foreign LLC, meaning an LLC organized under the laws of another state or country, that wishes to conduct business in Kansas must file the Kansas FL 51-10 form with the Kansas Office of the Secretary of State.

What documents are required to accompany the Kansas FL 51-10 form?

To successfully file the FL 51-10 form, a foreign LLC must include the original certificate of good standing or existence from the state, country, or other jurisdiction where it is organized. This certificate should be issued within 90 days prior to filing the application in Kansas.

Is there a filing fee for the Kansas FL 51-10 form?

Yes, there is a filing fee of $165 for the Kansas FL 51-10 form. The filing fee should be paid via check or money order made payable to the Secretary of State. Applications submitted without the appropriate fee will not be accepted.

What happens if the LLC's name is already in use in Kansas?

If the LLC applying for authority has the same name as an existing entity on file, the LLC must either provide a letter of consent from the existing entity to use the name or include a letter stating the LLC will use its home state as a means of identification in its advertising in Kansas.

Who can serve as the resident agent for a foreign LLC in Kansas?

The resident agent for a foreign LLC in Kansas can be either an individual or an entity that is authorized to accept service of process on behalf of the business. The address provided for the resident agent must be a physical street address in Kansas; P.O. Boxes are not acceptable.

What is the purpose of the resident agent?

The resident agent's role is to accept service of process, or lawsuits, on behalf of the foreign LLC. While this does not mean the agent is being sued personally, they have the authority and responsibility to receive legal documents for the company.

How can an entity ensure their application is processed smoothly?

To ensure the application is processed without delays, all information requested on the form must be complete and accurate. Additionally, applicants are advised not to use staples on their documents or checks to facilitate easier handling by the Secretary of State's office.

What is required if an entity has been doing business in Kansas without registration?

If the foreign LLC has been conducting business in Kansas for at least six months prior to filing the FL 51-10 form, it may be subject to annual reports and/or penalty fees according to K.S.A. 17-76, 139. It's important to address these requirements promptly.

How can one stay updated on their organization’s status in Kansas?

Foreign LLCs can stay informed about their organization’s status, annual report due dates, and contact addresses by visiting the Kansas Secretary of State’s official website at www.sos.ks.gov.