Kansas K 19 PDF Form

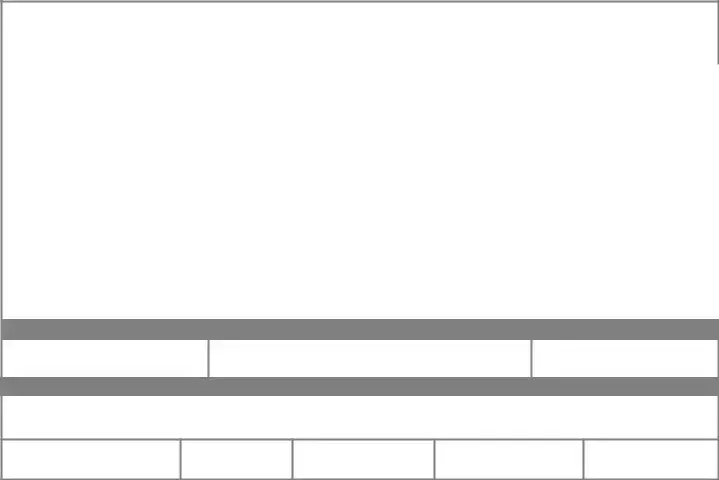

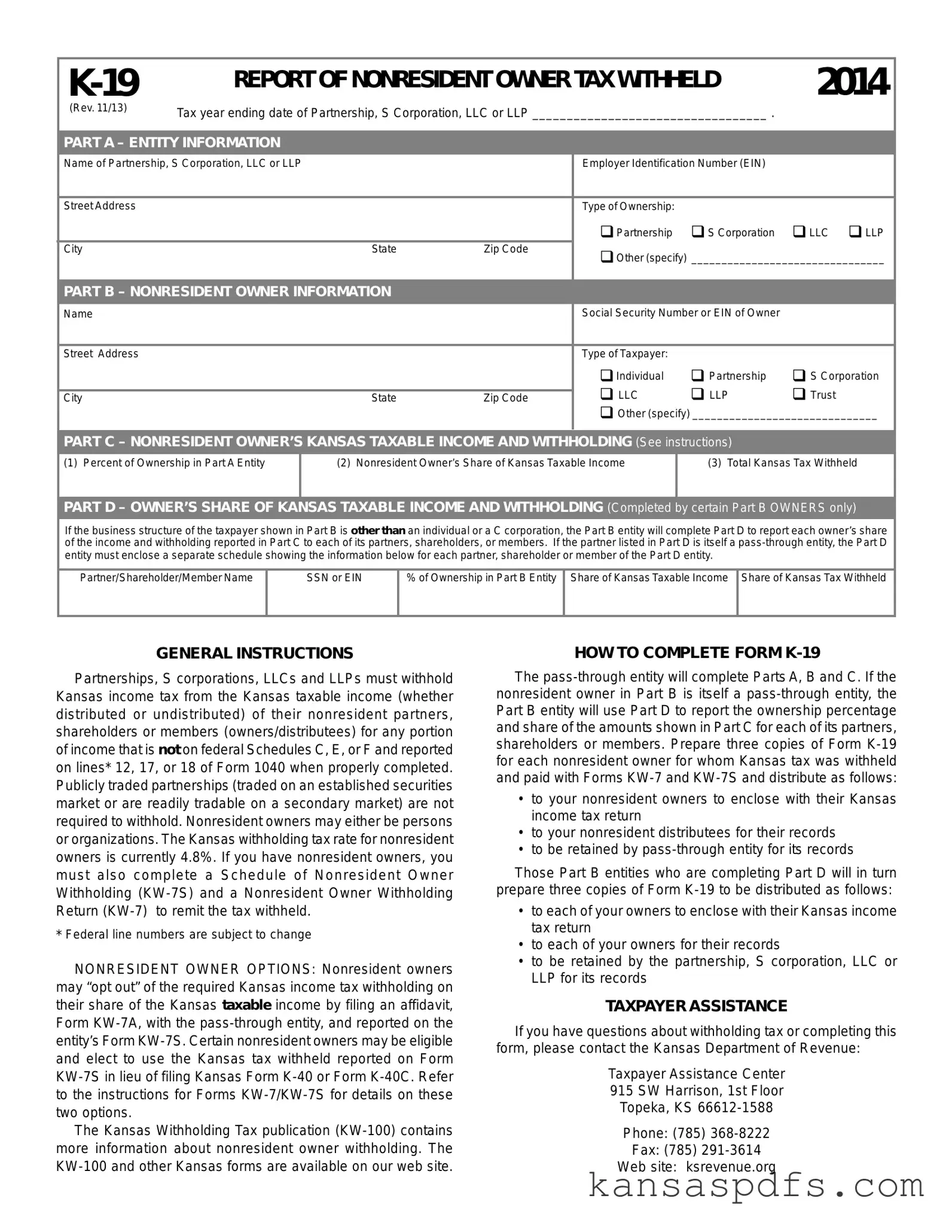

The Kansas K-19 form, officially titled the "Report of Nonresident Owner Tax Withheld 2013," is a crucial document for partnerships, S corporations, LLCs, and LLPs that outlines the required income tax withholding on Kansas taxable income for nonresident partners, shareholders, or members. This form ensures compliance with Kansas state tax laws by detailing the percentage of ownership, the share of Kansas taxable income, and the total Kansas tax withheld for each nonresident owner. To streamline the process of complying with Kansas tax obligations for nonresident owners, interested parties are encouraged to click the button below to fill out the form.

Get My Form Now

Kansas K 19 PDF Form

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Kansas K 19 online with quick edits and instant download.