|

|

GENERAL INSTRUCTIONS |

SPECIFIC LINE INSTRUCTIONS |

|

K.S.A. 74-8133 provides a tax credit against the income or |

|

|

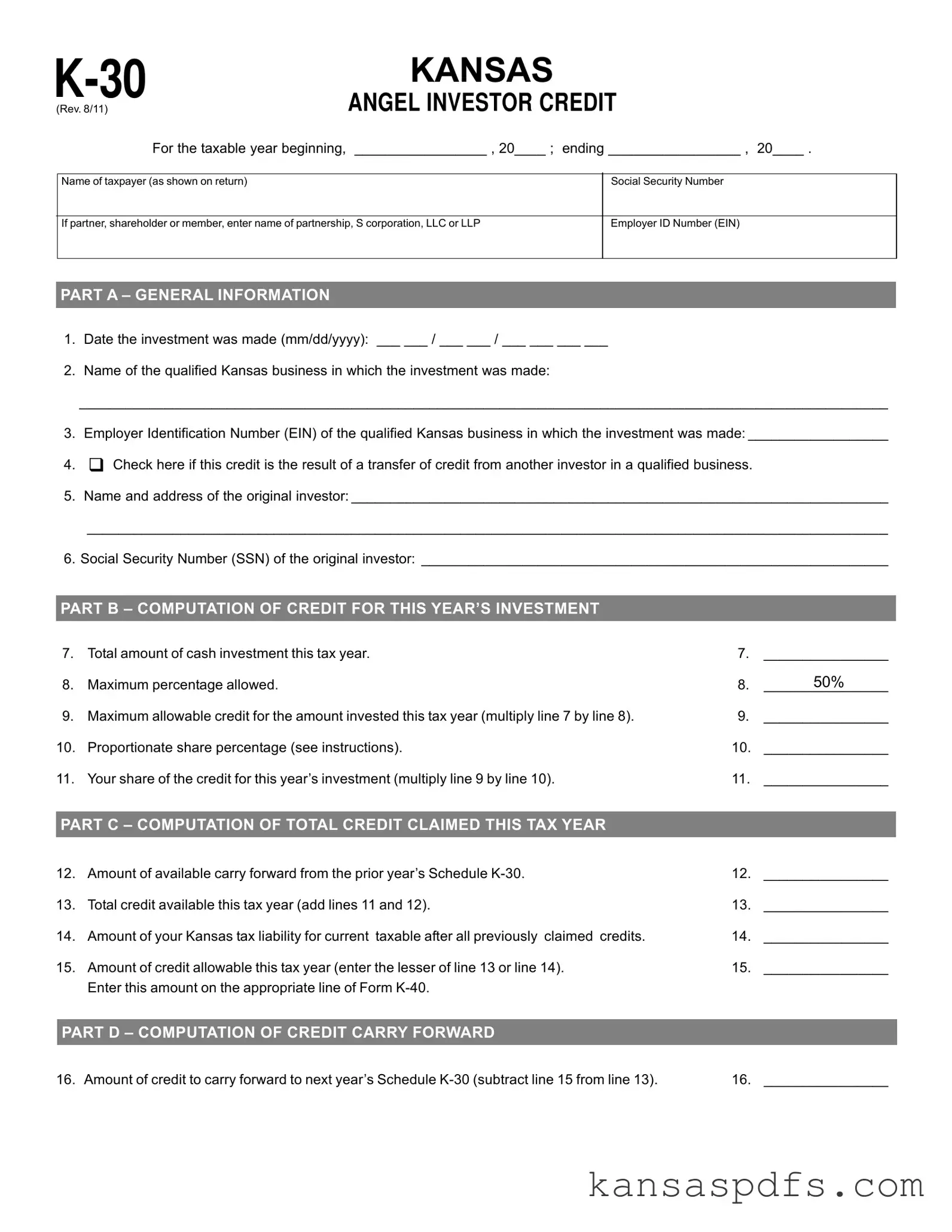

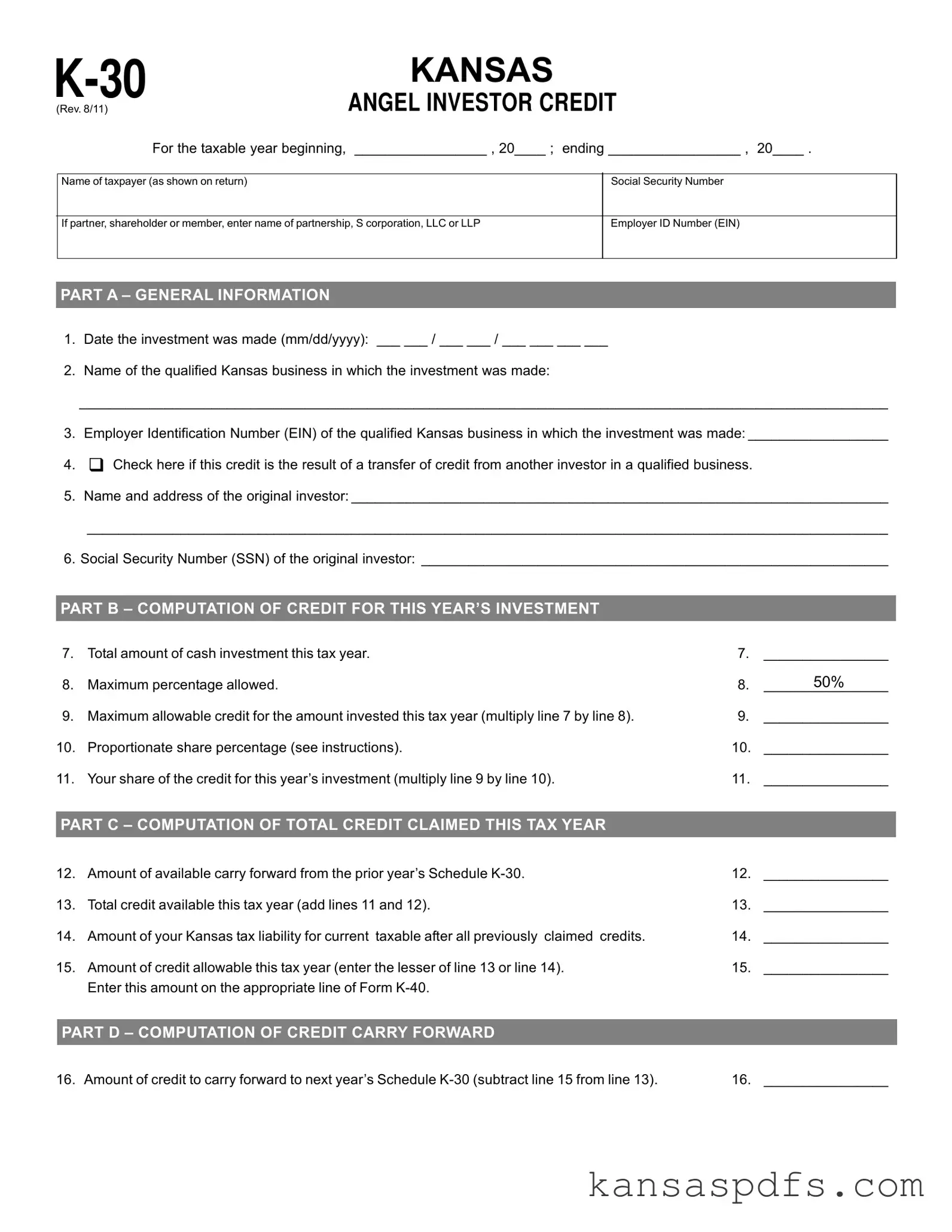

PART A —GENERAL INFORMATION |

|

|

premium tax of any angel investor for a cash investment in the |

LINES 1 through 6 – Complete the information for the qualified |

|

qualified securities of a qualified Kansas business. |

|

Kansas business and original investor as requested. |

|

Before an angel investor may be entitled to receive tax credits, |

|

|

|

|

such investor must have made a cash investment in a qualified |

PART B —COMPUTATION OF CREDIT FOR THIS YEAR’S INVESTMENT |

|

|

security of a qualified Kansas business. The investment must be |

LINE 7 – Enter total amount of cash investment made this tax year. |

|

made in a business that has been approved by KTEC (Kansas |

|

LINE 8 – This percentage determines the maximum credit allowable |

|

Technology Enterprise Corporation) as a qualified business prior |

|

as a result of the investment made during this tax year. Do not |

|

to the date on which the cash investment is made. For information |

|

make an entry on this line. |

|

and assistance regarding the approval of a qualified Kansas |

|

LINE 9 – Multiply line 7 by line 8 and enter the result. This is the |

|

business, contact KTEC at (785) 296-5272. |

|

maximum credit allowable. |

|

The credit is 50% of such investors’ cash investment in any |

|

LINE 10 – Partners, shareholders or members: Enter the percentage |

|

qualified Kansas business, subject to the following limitations: |

|

that represents your proportionate share in the partnership, S |

|

|

|

|

• No tax credits will be allowed for more than $50,000 for a single |

corporation, LLC or LLP. All other taxpayers: Enter 100%. |

|

|

Kansasbusinessoratotalof$250,000intaxcreditsforasingle |

LINE 11 – Multiply line 9 by line 10 and enter result. This is your |

|

|

year per investor who is a natural person or owner of a |

share of the total credit for the amount invested this year. |

|

|

permitted entity investor. |

|

|

|

|

PART C —COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR |

|

|

• No tax credits shall be allowed for any cash investments in |

|

|

LINE 12 – Enter the carry forward amounts available from prior |

|

|

qualified securities for any year after the year 2016. |

|

• |

The total amount of tax credits shall not exceed $6,000,000 |

years’ K-30 schedules and enclose a copy of those schedules. |

|

2010 legislation (SB 430) allows taxpayers that had credits |

|

|

for tax year 2008 and each tax year thereafter, except that for |

|

|

earned pursuant to K.S.A. 74-8133 to carry forward to tax |

|

|

tax year 2011, the total amount of tax credits shall not exceed |

|

|

year 2011 any reduction that occurred in tax year 2009 |

|

|

$5,000,000. |

|

|

and/or 2010. Enter those amounts here on line 12. |

|

• |

No investor shall claim a credit for cash investments in Kansas |

|

LINE 13 – Add lines 11 & 12 and enter the result. |

|

|

Venture Capital, Inc. |

|

|

LINE 14 – Enter your total Kansas tax liability for the current tax |

|

• |

No Kansas venture capital company shall qualify for the tax |

|

year after all credits other than the credit allowed for |

|

|

credit for an investment in a fund created by articles 81, 82, |

|

|

investments made during this tax year. |

|

|

83 or 84 of chapter 74 of the Kansas Statutes Annotated. |

|

|

LINE 15 – Enter the lesser of line 13 or line 14. Enter this amount |

|

If the amount by which that portion of the credit allowed by this |

|

on the appropriate line of Form K-40. |

|

section exceeds the investors’ liability in any one taxable year, the |

|

|

|

|

PART D —COMPUTATION OF CARRY FORWARD CREDIT |

|

|

remaining portion of the credit may be carried forward until the total |

|

|

|

|

|

amount of the credit is used. If the investor is a permitted entity |

LINE 16 – Subtract line 15 from line 13 and enter result. This |

|

investor, the credit provided by this section shall be claimed by the |

|

amount cannot be less than zero. Enter this amount on next |

|

owners of the permitted entity investor in proportion to their |

|

year’s Schedule K-30. |

|

|

|

|

ownership share of the permitted entity investor. |

|

|

|

Subject to certain restrictions this credit may be transferred to |

IMPORTANT: Do not send any enclosures with this |

|

schedule. A copy of the approved KTEC certification |

|

another taxpayer. Contact KTEC at (785) 296-5272 for more |

|

form must be kept with your records. If this is a credit |

|

information. |

|

that has been transferred, documentation of the approved transfer |

|

|

|

|

“Angel investor’’and ‘‘investor’’meanYXWVUTSRan accredited investor |

|

|

|

as provided by KDOR (Kansas Department of Revenue) must be |

|

who is a natural person or an owner of a permitted entity investor, |

retained with your records. KDOR reserves the right to request |

|

who is of high net worth, as defined in 17 C.F.R. 230.501(a) as in |

additional information as necessary. |

|

effect on the effective date of this act, and who seeks high returns |

|

|

|

through private investments in start-up companies and may seek |

TAXPAYERASSISTANCE |

|

active involvement in business, such as consulting and mentoring |

For assistance in completing this schedule contact the Kansas |

|

the entrepreneur. |

|

Department of Revenue: |

|

“Cash investment” means money or money equivalent in |

|

Tax Operations |

|

consideration for qualified securities. |

|

Docking State Office Building, 1st fl. |

|

“Permittedentityinvestor”means any: a) general partnership, |

|

915 SW Harrison St. |

|

limited partnership, corporation that has in effect a valid election |

|

Topeka, KS 66625-2007 |

|

to be taxed as an S corporation under the United States Internal |

|

Phone: (785) 368-8222 |

|

Revenue Code, or a limited liability company that has elected to |

|

Fax: (785) 291-3614 |

|

be taxed as a partnership under the United States Internal Revenue |

|

|

|

|

Code; and, b) that was established and is operated for the sole |

Additional copies of this credit schedule and other tax forms |

|

purpose of making investments in other entities. |

are available from our web site at: ksrevenue.org |