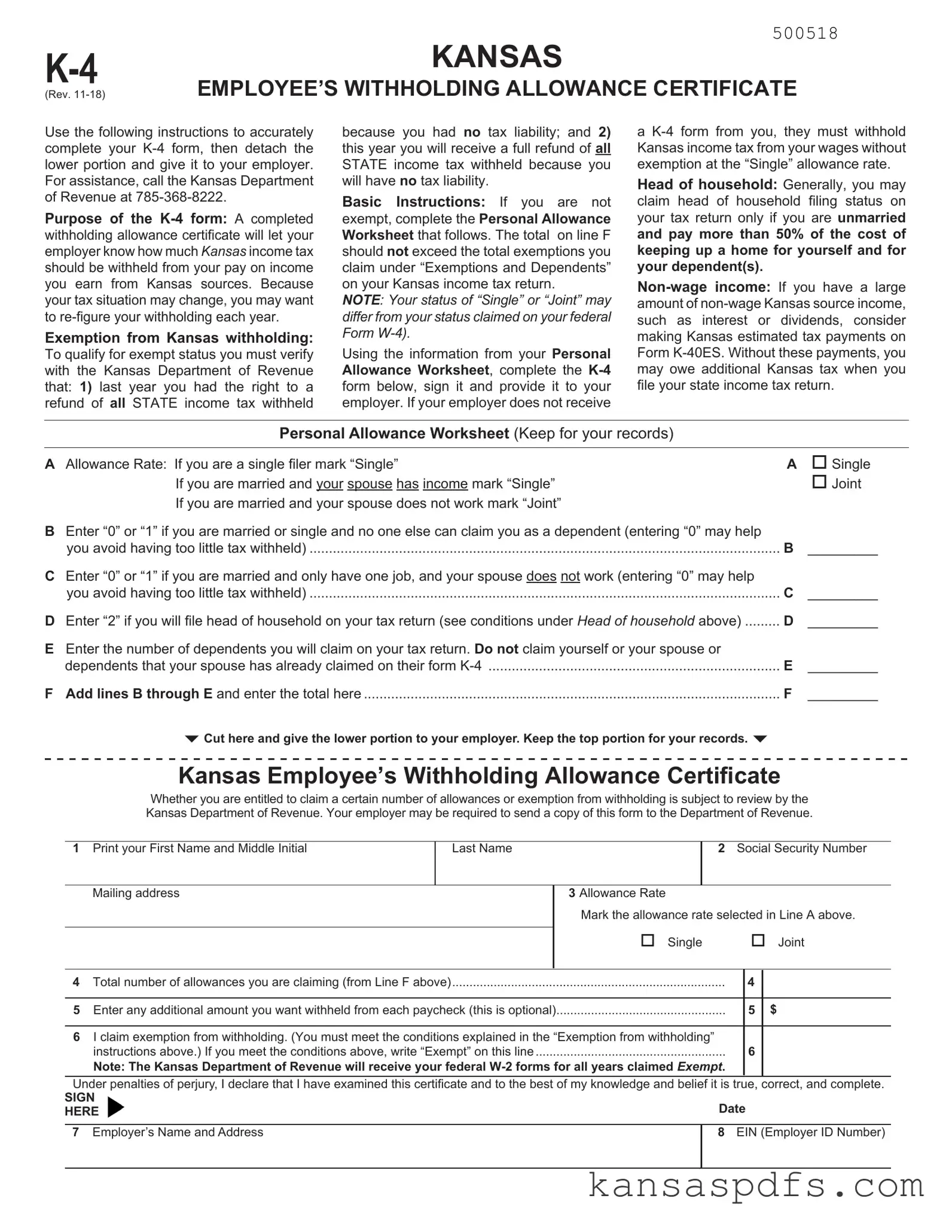

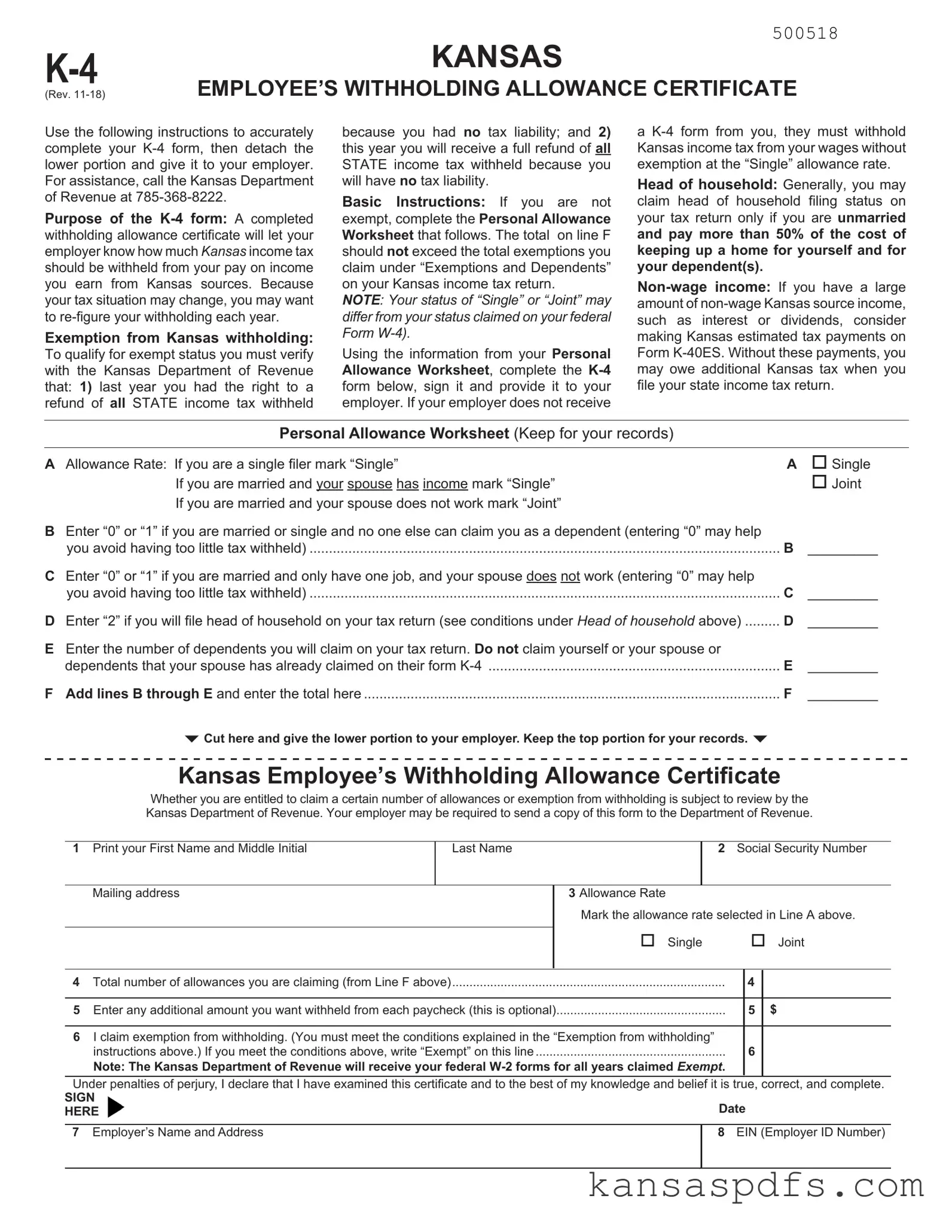

What is the purpose of the Kansas K-4 form?

The K-4 form is designed to let your employer know how much Kansas income tax should be withheld from your wages. This is important for ensuring that the right amount of tax is taken out of your paycheck based on the income you earn from Kansas sources. Since your tax situation can change from year to year, it's a good idea to reevaluate your withholding allowances annually.

Can I claim exemption from withholding on the K-4 form?

Yes, you can claim exemption from Kansas withholding if you meet two conditions: you had a right to a refund of all Kansas state income tax withheld last year because you had no tax liability, and you expect to have no tax liability this year, ensuring a full refund of any state income tax withheld. Be prepared to verify these conditions with the Kansas Department of Revenue.

How do I complete the Kansas K-4 form if I am not exempt?

If you're not exempt from Kansas state income tax withholding, you'll need to complete the Personal Allowance Worksheet included with the K-4 form. This worksheet helps you calculate the total number of allowances you're entitled to claim. Make sure the total on line F does not exceed the exemptions you claim on your Kansas income tax return. Fill out the K-4 form with your personal information and the total number of allowances and give it to your employer.

What happens if I do not submit a K-4 form to my employer?

If you do not submit a completed K-4 form to your employer, they are required to withhold Kansas income tax from your wages at the single allowance rate without exemptions. This could result in more tax being withheld from your paycheck than necessary.

Can my filing status on the K-4 form differ from my federal W-4 form?

Yes, your filing status on the K-4 form may differ from what you claim on your federal W-4 form. This flexibility allows you to tailor your withholding to better meet your individual tax responsibilities in Kansas.

What should I do if I have a large amount of non-wage Kansas source income?

If you receive a significant amount of non-wage income from Kansas sources, such as interest or dividends, you might need to make estimated tax payments using Form K-40ES. This can help avoid owing additional tax when you file your state income tax return.

What does it mean to file as head of household on the Kansas K-4 form?

If you file as head of household, it generally means you are unmarried and pay more than 50% of the costs to maintain a home for yourself and your dependent(s). When filing your tax return, this status could affect your tax withholding and liability.

Where can I find assistance if I have questions about completing the K-4 form?

If you have questions or need assistance with filling out the Kansas K-4 form, you can call the Kansas Department of Revenue at 785-368-8222. They can provide guidance and answer any questions you might have.

What should I do if my personal or financial situation changes after I've submitted my K-4 form?

If your personal or financial circumstances change, such as getting married, having a child, or experiencing a significant change in income, you should consider filling out a new K-4 form. Adjusting your allowances or exemption status can help ensure the correct amount of tax is withheld from your paychecks.