|

|

|

|

|

|

|

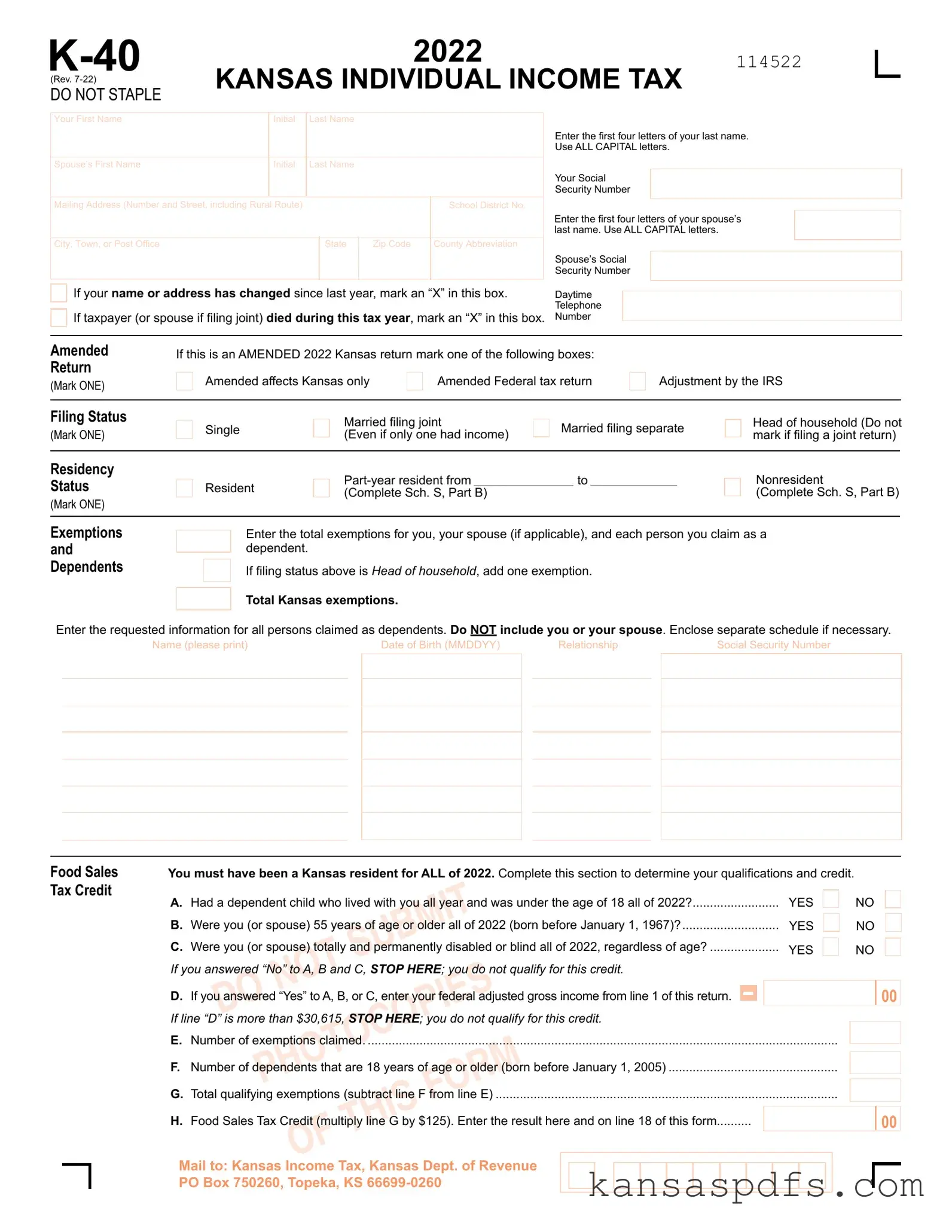

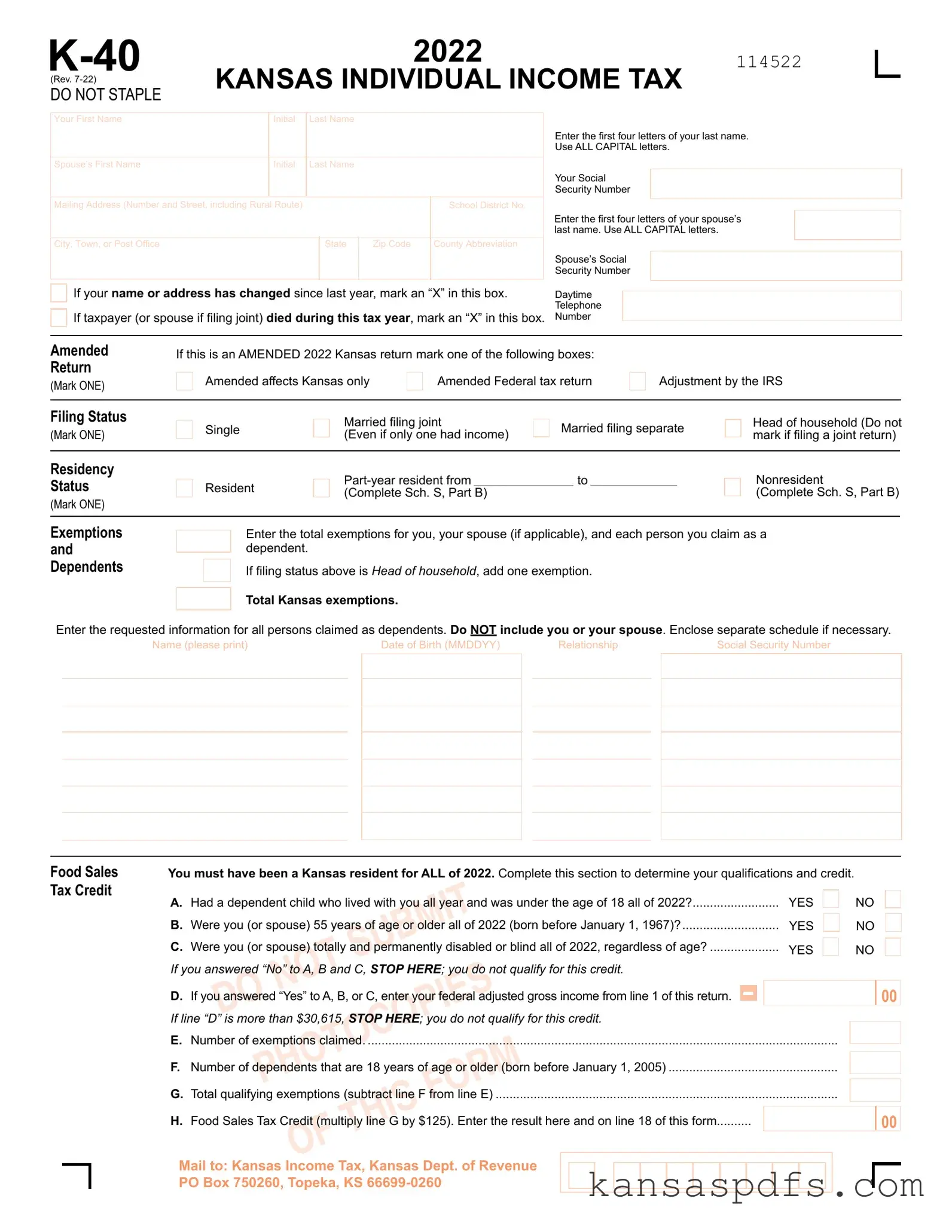

ENTER AMOUNTS IN WHOLE DOLLARS ONLY |

|

|

|

|

|

|

114222 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

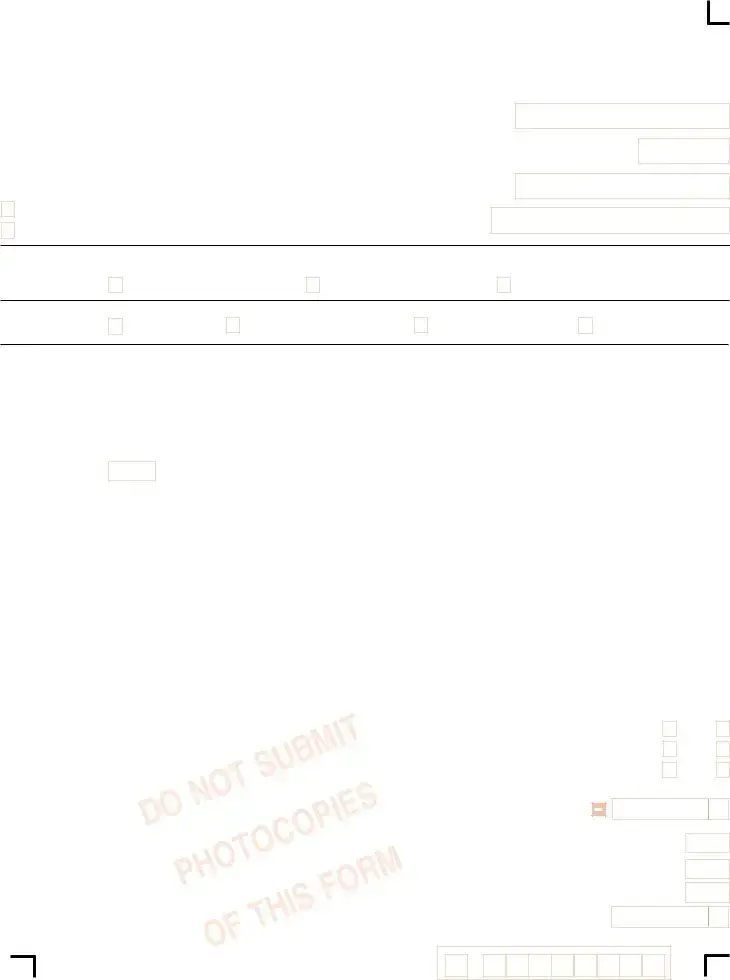

Income |

1. |

Federal adjusted gross income (as reported on your federal income tax return) |

|

1 |

|

|

|

|

|

00 |

|

Shade the box for |

2. |

.......................................Modifications (from Schedule S, line A25; enclose Schedule S) |

|

2 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

negative amounts. |

3. |

Kansas adjusted gross income (line 2 added to or subtracted from line 1) |

|

|

|

|

|

|

|

|

|

|

Example: |

|

|

|

3 |

|

|

|

|

|

00 |

|

Deductions |

4. |

Standard deduction OR itemized deductions (if itemizing, complete Kansas Schedule A) |

... |

|

4 |

|

|

00 |

|

|

|

|

|

|

5. |

Exemption allowance ($2,250 x number of exemptions claimed) |

|

|

|

5 |

|

|

00 |

|

|

|

|

|

|

6. |

Total deductions (add lines 4 and 5) |

|

|

|

6 |

|

|

00 |

|

|

|

|

|

|

7. |

.......................................Taxable income (subtract line 6 from line 3; if less than zero, enter 0) |

|

|

|

|

7 |

|

|

00 |

|

Tax |

8. |

Tax (from Tax Tables or Tax Computation Schedule) |

|

|

|

8 |

|

|

00 |

|

Computation |

9. |

Nonresident percentage (from Schedule S, line B23; or if 100%, enter 100.0000) |

|

|

|

9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Nonresident tax (multiply line 8 by line 9) |

|

|

|

10 |

|

|

00 |

|

|

|

|

|

|

11. |

Kansas tax on lump sum distributions (residents only - see instructions) |

|

|

|

11 |

|

|

00 |

|

|

|

|

|

|

12. |

TOTAL INCOME TAX (residents: add lines 8 & 11; nonresidents: enter amount from line 10).. |

|

12 |

|

|

00 |

|

Credits |

13. |

Credit for taxes paid to other states (see instructions; enclose return(s) from other states) |

|

|

|

|

13 |

|

|

00 |

|

|

|

|

|

|

14. |

Credit for child and dependent care expenses (residents only - see instructions) |

|

|

|

14 |

|

|

00 |

|

|

|

|

|

|

15. |

Other credits (enclose all appropriate credit schedules) |

|

|

|

15 |

|

|

00 |

|

|

|

|

|

|

16. |

Subtotal (subtract lines 13, 14 and 15 from line 12) |

|

|

|

16 |

|

|

00 |

|

|

|

|

|

|

17. |

Earned income tax credit (from worksheet on page 8 of instructions) |

|

|

|

17 |

|

|

00 |

|

|

|

|

|

|

18. |

Food sales tax credit (from line H, front of this form) |

|

|

|

18 |

|

|

00 |

|

|

|

|

|

|

19. |

Total tax balance (subtract lines 17 and 18 from line 16; cannot be less than zero) |

|

|

|

|

19 |

|

|

00 |

|

Withholding |

20. |

Kansas income tax withheld from W-2s and/or 1099s |

|

|

|

20 |

|

|

00 |

|

and |

21. |

Estimated tax paid |

|

|

|

|

|

|

21 |

|

|

00 |

|

Payments |

22. |

Amount paid with Kansas extension |

|

|

|

22 |

|

|

00 |

|

If this is an AMENDED |

23. |

Refundable portion of earned income tax credit (from worksheet, page 8 of instructions).... |

|

|

|

23 |

|

|

00 |

|

return, complete lines |

24. |

Refundable portion of tax credits |

|

|

|

24 |

|

|

00 |

|

25, 26 and 27 |

|

|

|

|

|

|

|

|

|

|

|

25. |

Payments remitted with original return |

|

|

|

25 |

|

|

00 |

|

|

|

|

|

|

26. |

Credit for tax paid on the K-120S (enclose K-9) |

|

|

|

26 |

|

|

00 |

|

|

|

|

|

|

27. |

Overpayment from original return (this figure is a subtraction; see instructions) |

|

|

|

|

|

27 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28. |

...........................Total refundable credits (add lines 20 through 26; then subtract line 27) |

|

28 |

|

|

|

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

Balance |

29. |

Underpayment (if line 19 is greater than line 28, enter the difference here) |

|

|

|

|

29 |

|

|

00 |

|

Due |

30. |

Interest (see instructions) |

|

|

|

|

|

|

30 |

|

|

00 |

|

|

|

|

|

|

31. |

Penalty (see instructions) |

|

|

|

|

|

|

31 |

|

|

00 |

|

|

|

|

|

|

32. |

Estimated Tax Penalty |

Mark box if engaged in commercial farming or fishing in 2022 .. |

|

32 |

|

|

00 |

|

|

|

|

|

|

33. |

AMOUNT YOU OWE (add lines 29 through 32 and any entries on lines 36 through 42) |

|

|

|

33 |

|

|

00 |

|

Overpayment 34. |

Overpayment (if line 19 is less than line 28, enter the difference here) |

|

|

|

|

34 |

|

|

00 |

|

|

|

|

35 |

|

|

00 |

|

You may donate to any |

35. |

CREDIT FORWARD (enter amount you wish to be applied to your 2023 estimated tax) |

|

|

|

|

|

|

of the programs on lines |

36. |

CHICKADEE CHECKOFF (Kansas Nongame Wildlife Improvement Program) |

|

|

|

36 |

|

|

00 |

|

36 through 42. |

|

|

|

|

|

|

|

|

|

37 |

|

|

00 |

|

The amount you enter |

37. |

SENIOR CITIZENS MEALS ON WHEELS CONTRIBUTION PROGRAM |

|

|

|

|

|

|

will reduce your refund |

|

|

|

|

|

|

|

|

|

38 |

|

|

00 |

|

or increase the amount |

38. |

BREAST CANCER RESEARCH FUND |

|

|

|

|

|

|

you owe. |

|

|

|

|

|

|

|

|

|

39 |

|

|

00 |

|

|

|

|

|

|

39. |

MILITARY EMERGENCY RELIEF FUND |

|

|

|

|

|

|

|

|

|

|

|

40. |

KANSAS HOMETOWN HEROES FUND |

|

|

|

40 |

|

|

00 |

|

|

|

|

|

|

41. |

KANSAS CREATIVE ARTS INDUSTRY FUND |

|

|

|

41 |

|

|

00 |

|

|

|

|

|

|

42. |

LOCAL SCHOOL DISTRICT CONTRIBUTION FUND School District Number |

|

|

|

|

|

42 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. |

REFUND (subtract lines 35 through 42 from line 34) |

|

|

|

43 |

|

|

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|