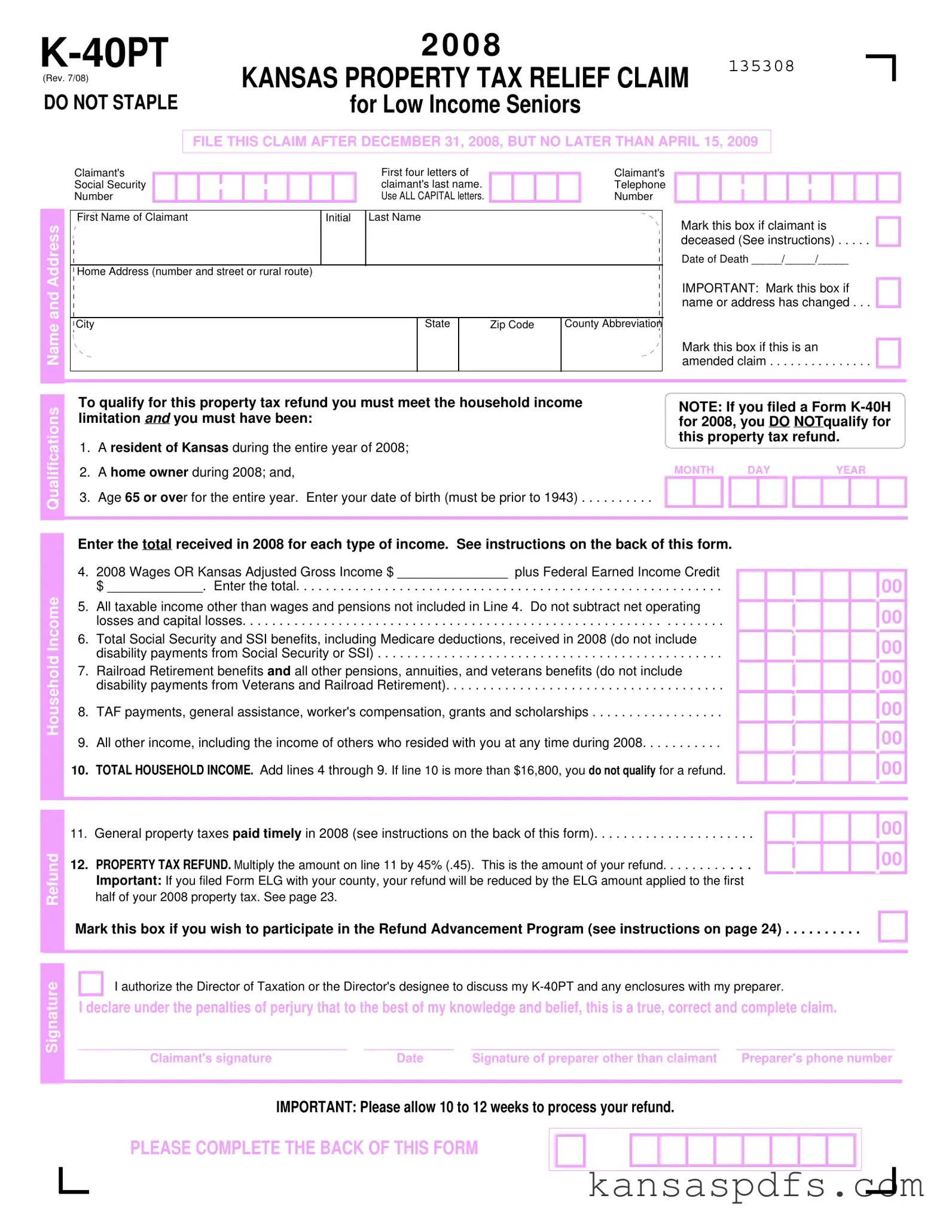

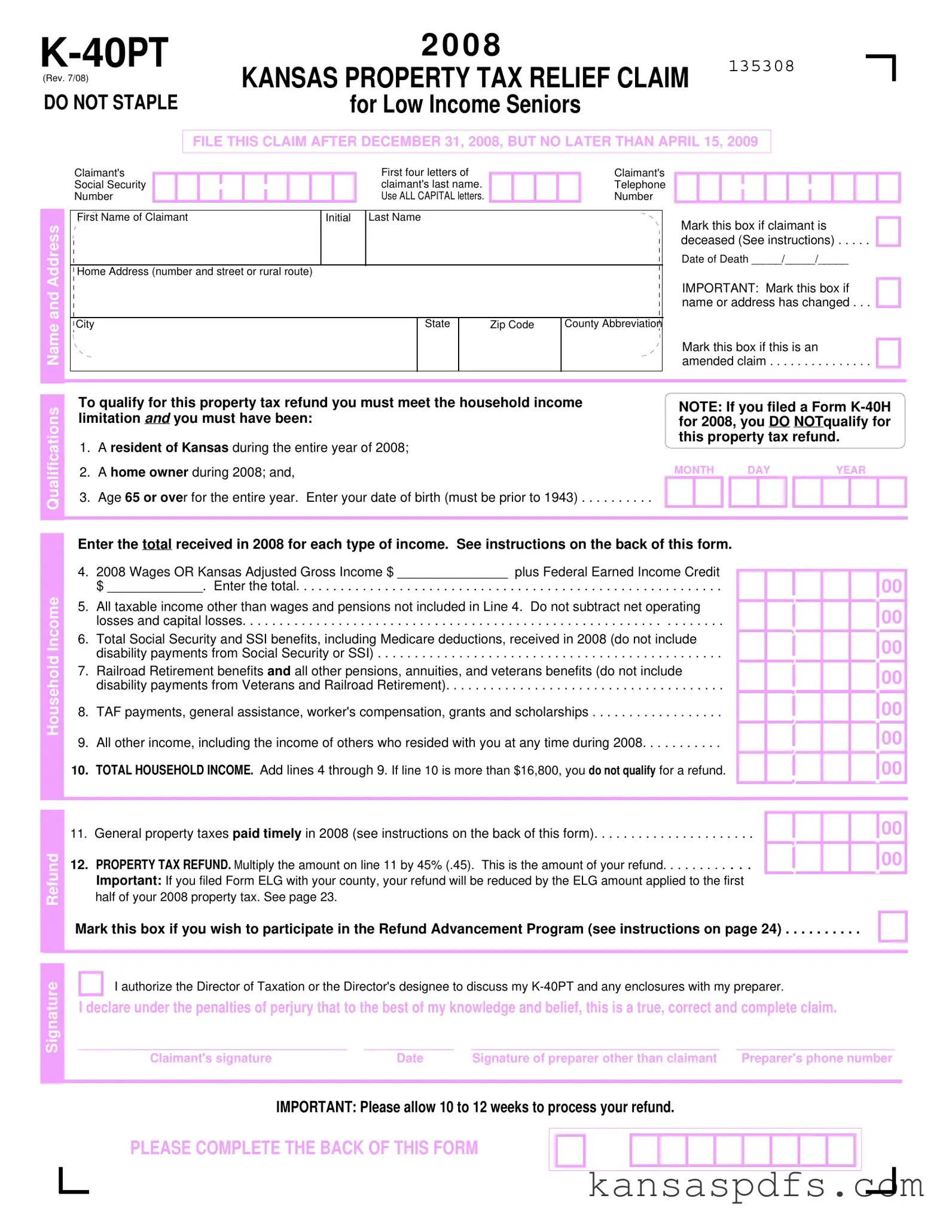

Kansas K 40Pt PDF Form

The Kansas K-40PT form, officially known as the Kansas Property Tax Relief Claim for Low Income Seniors, is designed to provide a refund on property taxes paid by qualifying senior citizens with limited income. Eligibility requires being a Kansas resident for the entire year of 2008, owning a home during the same period, and being 65 years or older. To access the benefits of this program, eligible seniors must file this claim between December 31, 2008, and April 15, 2009. Ready to apply for your property tax relief? Click the button below to get started.

Get My Form Now

Kansas K 40Pt PDF Form

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Kansas K 40Pt online with quick edits and instant download.