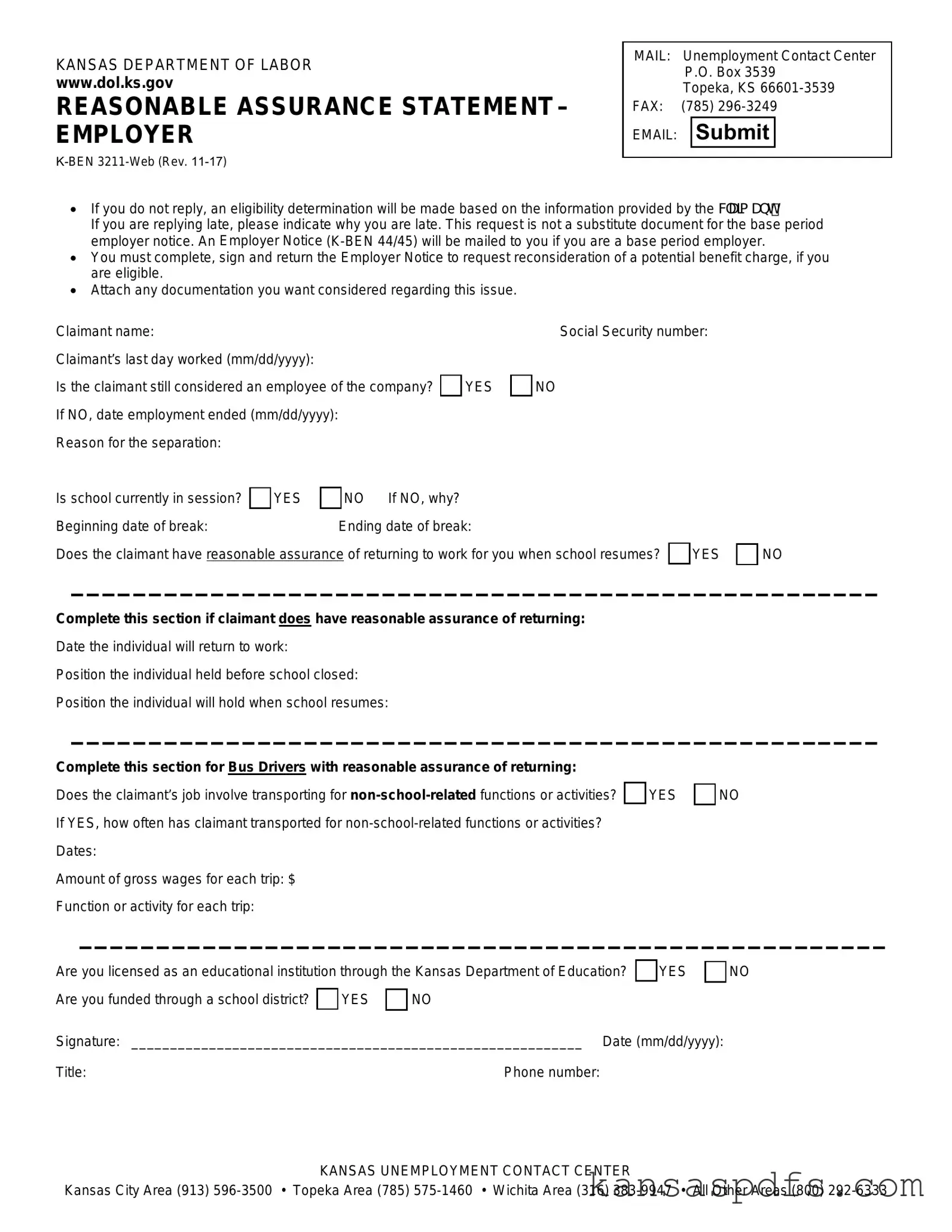

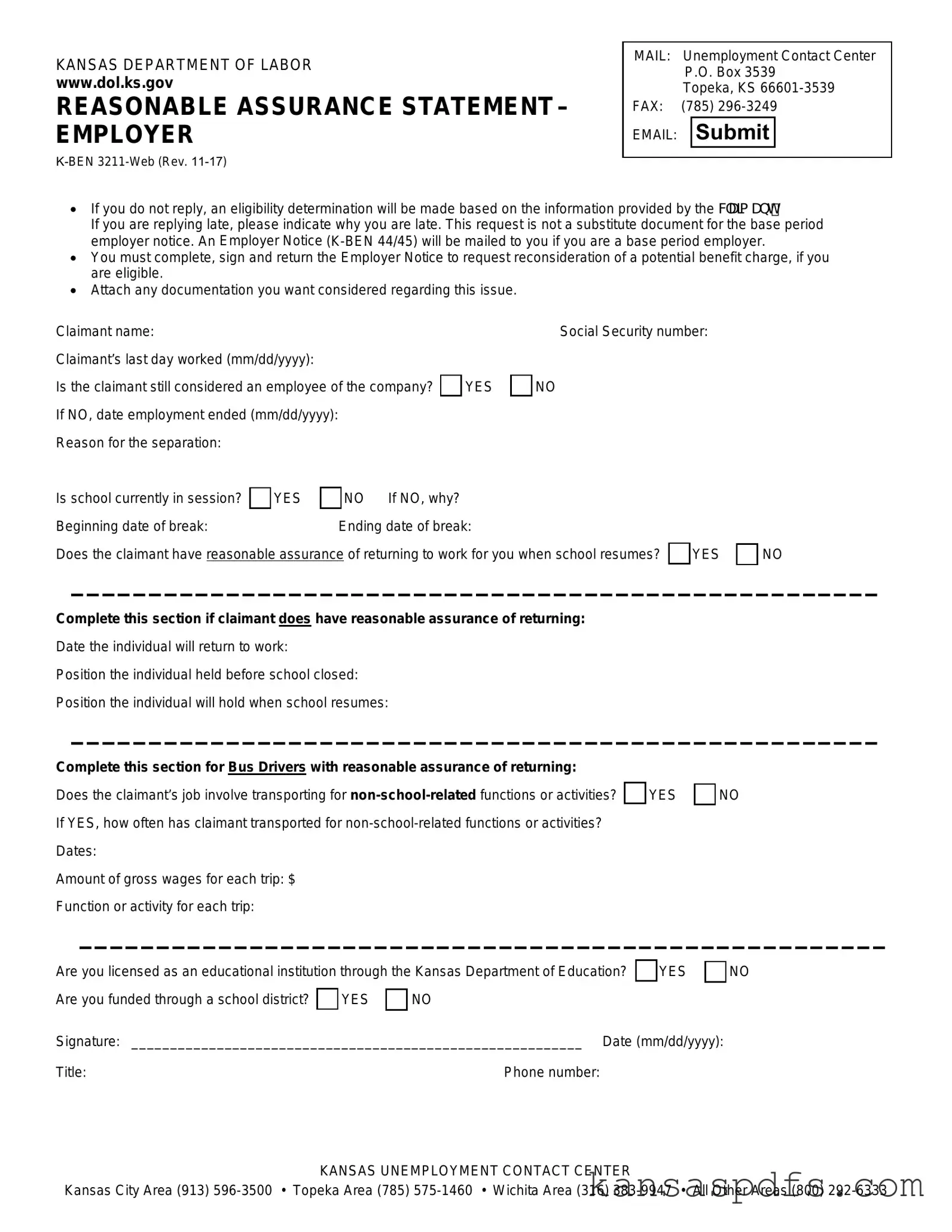

What is the purpose of the Kansas K-BEN 3211 form?

The Kansas K-BEN 3211 form, known as the Reasonable Assurance Statement, is used by employers to provide information relevant to an employee's unemployment claim, specifically regarding the assurance of employment when school resumes for educational employees. By completing this form, employers can detail whether an employee is expected to return to work after a school break, which factors into the entity’s unemployment insurance obligations and the employee's eligibility for benefits.

Who needs to fill out the K-BEN 3211 form?

Employers who receive a request from the Kansas Department of Labor must fill out the K-BEN 3211 form. This form is specifically targeted at employers associated with educational institutions when there is a question regarding an employee's reasonable assurance of returning to work after a break or recess, such as summer or winter holidays.

What happens if I don't respond to the request for a K-BEN 3211 form?

If an employer fails to respond to the request for completing the K-BEN 3211 form, the Kansas Department of Labor will make an eligibility determination based on the information already provided by the claimant. Not responding could impact the outcome of the claim and potentially affect the employer's liability regarding unemployment benefits.

Can I submit the K-BEN 3211 form late?

Yes, employers can submit the K-BEN 3211 form late, but they must include a reason for the delay. It’s important to note that late submissions may delay the decision-making process regarding the claimant's eligibility for unemployment benefits.

Is there any documentation that should be attached with the K-BEN 3211 form?

Yes, if there is relevant documentation that supports the information provided in the form or any evidence that could affect the reasonable assurance consideration, it should be attached. This documentation could include schedules, contracts, or letters indicating the employer’s intent to rehire the employee after the break.

How does the K-BEN 3211 form affect unemployment claims?

The completion of the K-BEN 3211 form directly influences the assessment of a claimant's eligibility for unemployment benefits. If an employee has reasonable assurance of returning to work, they might not be eligible for benefits during the school break. The information provided helps determine whether the break in employment qualifies the claimant for unemployment benefits.

What should I include in the "Complete this section for Bus Drivers" part of the form?

In this section, employers of bus drivers should detail any non-school-related transportation roles the claimant might have performed. This includes the frequency of such duties, the dates, the amount of gross wages for each trip, and the nature of each function or activity. This information is vital for determining whether these activities affect the claimant's eligibility for unemployment benefits.

Where can I submit the completed K-BEN 3211 form?

The completed form can be submitted to the Kansas Department of Labor via mail, fax, or email. The mailing address is Unemployment Contact Center, P.O. Box 3539, Topeka, KS 66601-3539. The fax number is (785) 296-3249. For email submissions, employers should refer to the Kansas Department of Labor’s official website for the specific email address or additional submission instructions.