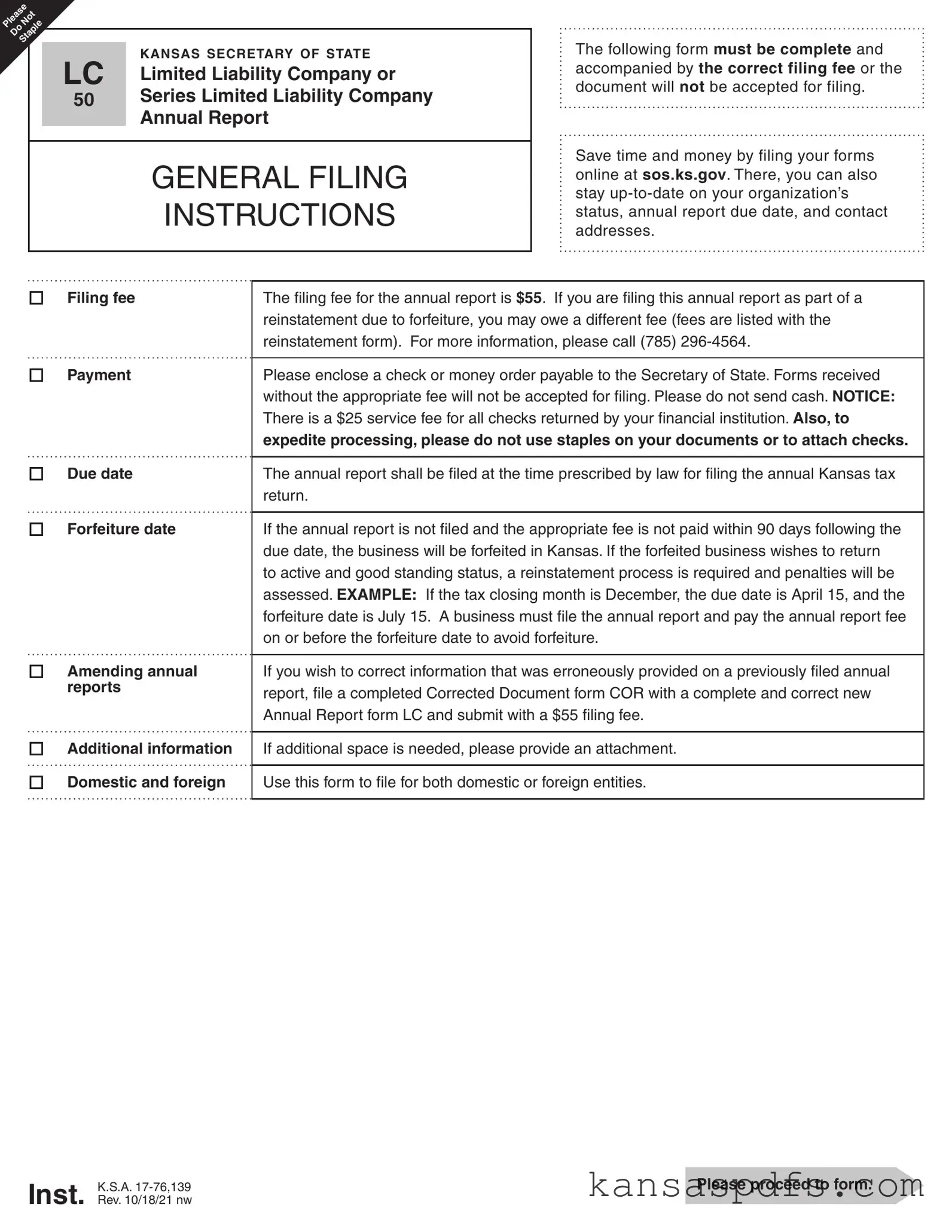

What is the Kansas LC 50 form?

The Kansas LC 50 form refers to the Limited Liability Company or Series Limited Liability Company Annual Report that must be filed with the Kansas Secretary of State. This form is a critical document used to report and update the state on the company's essential information annually. It ensures that the business remains in good standing by adhering to the state requirements.

Who needs to file this form?

Both domestic (Kansas-based) and foreign (outside Kansas) Limited Liability Companies (LLCs) and Series Limited Liability Companies that are registered to operate in Kansas are required to file this form. All entities of this nature must submit an annual report to the Secretary of State to maintain compliance with state regulations.

How much is the filing fee for the Kansas LC 50 form?

The filing fee for submitting an annual report using the Kansas LC 50 form is $55. If the report is filed as a part of the reinstatement process due to forfeiture, a different fee schedule might apply. It's important to include the filing fee with the submission, as forms received without the appropriate fee will not be processed.

What happens if the form and fee are not filed on time?

If the annual report and the associated fee are not filed within 90 days following the due date, the LLC will be forfeited in Kansas. To return to active and good standing status after forfeiture, the business must undergo a reinstatement process, which includes the assessment of penalties.

Can information on a previously filed annual report be corrected?

Yes, to correct information that was erroneously provided on a previously filed annual report, a Corrected Document form COR along with a new and complete Annual Report form LC must be submitted. The correction process also requires the submission of a $55 filing fee.

Is it possible to file the Kansas LC 50 form online?

Yes, filing online is encouraged as it can save time and money. The Kansas Secretary of State's website (sos.ks.gov) provides a platform where the LC 50 form can be submitted electronically. Online filing also allows businesses to stay up to date on their organization's status, annual report due dates, and contact addresses efficiently.