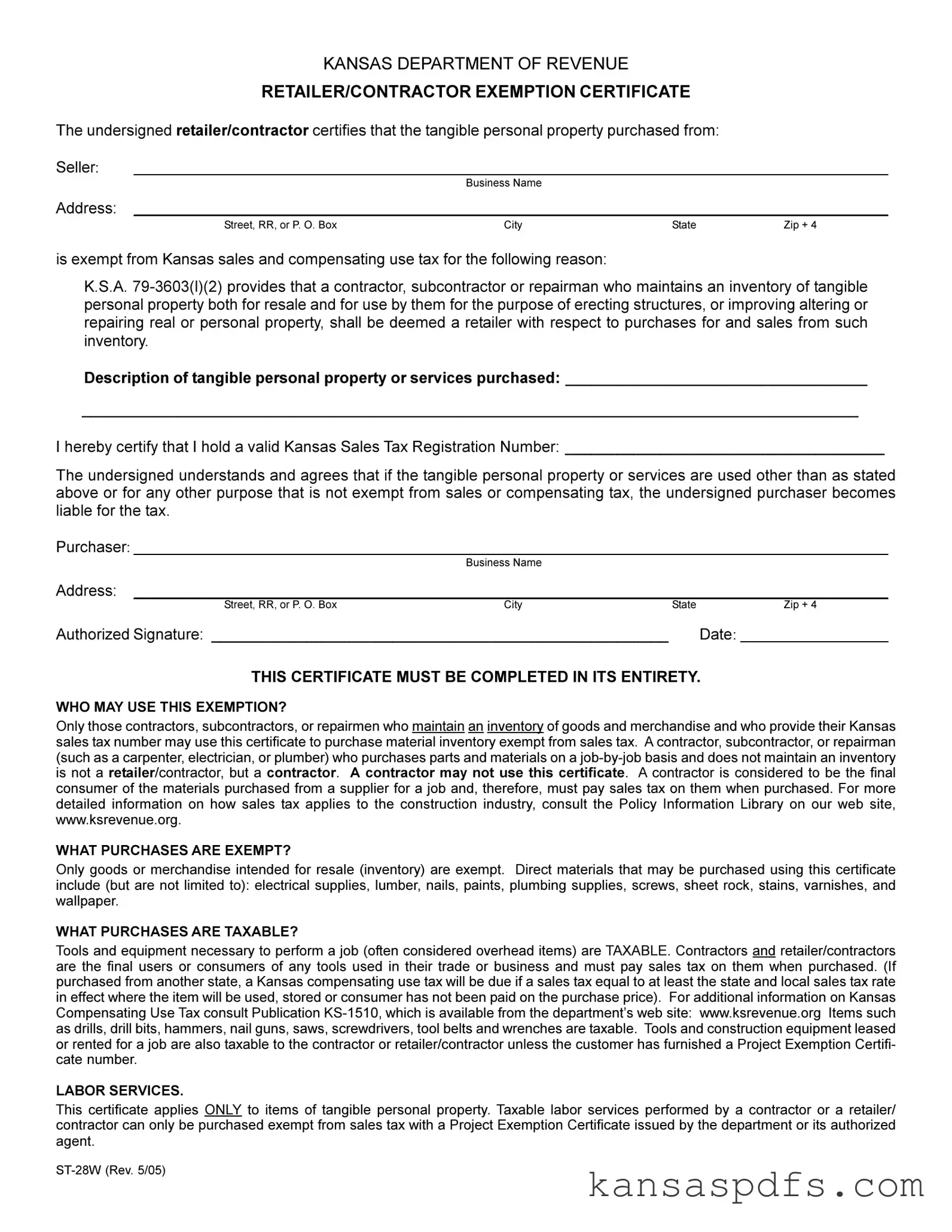

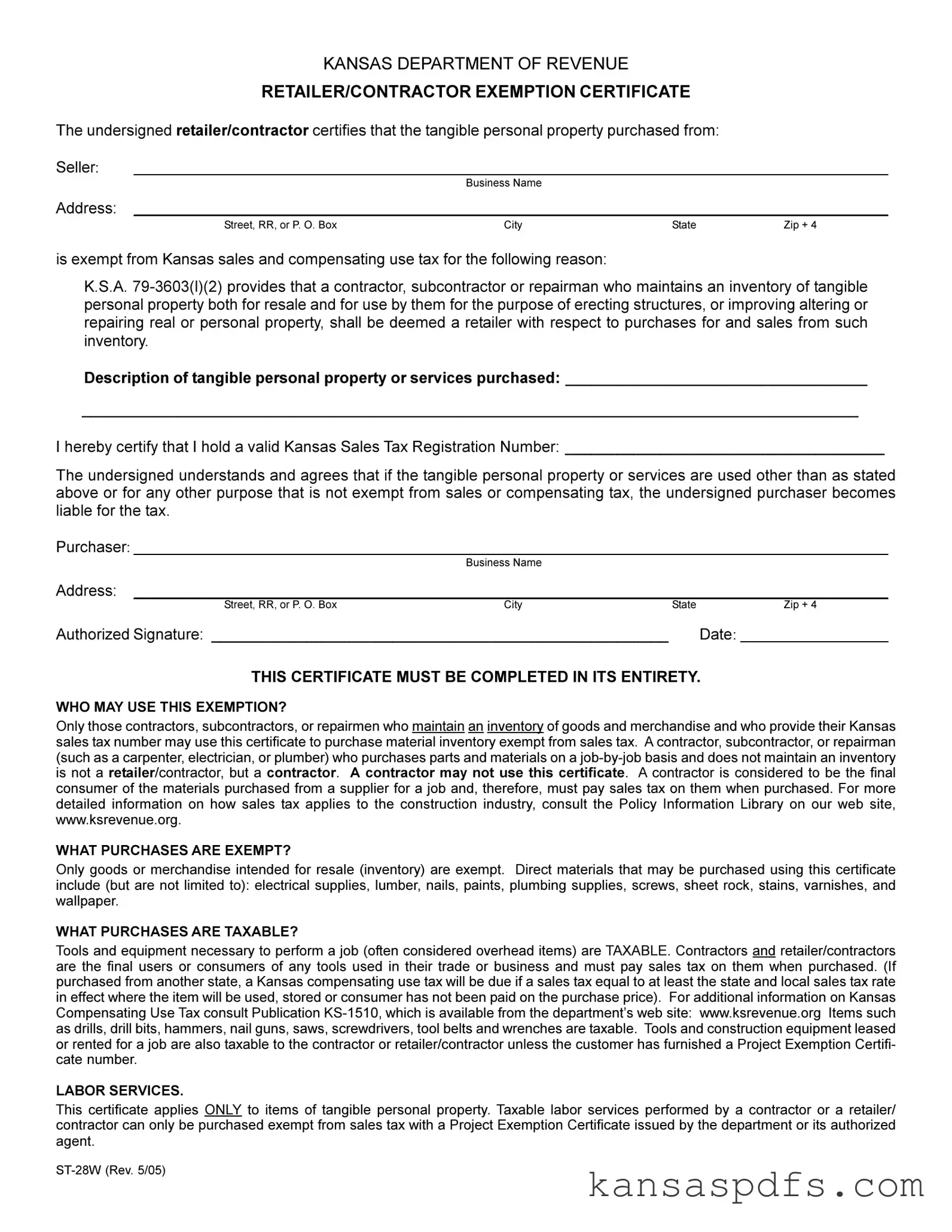

What is a Kansas ST 28W form?

The Kansas ST 28W form, designated as a Retailer/Contractor Exemption Certificate, is a document used by retailers, contractors, subcontractors, or repairmen who maintain an inventory of tangible personal property both for resale and for use in their business activities like erecting structures, or improving, altering, or repairing real or personal property. This certificate allows them to purchase material inventory exempt from Kansas sales and compensating use tax under specific conditions.

Who is eligible to use the Kansas ST 28W form?

Only contractors, subcontractors, or repairmen who maintain an inventory of goods and merchandise for the purpose of resale and who can provide their Kansas sales tax number may utilize this exemption certificate. This form is not applicable for those who purchase parts and materials on a job-by-job basis without maintaining an inventory, as they are considered the final consumer of the materials and must pay sales tax when purchased.

What purchases can be exempted using this form?

Goods or merchandise intended for resale as inventory can be purchased exempt from sales tax. This includes direct materials such as electrical supplies, lumber, nails, paints, plumbing supplies, screws, sheet rock, stains, varnishes, and wallpaper, among others, which are directly used in the business activities of construction, repairing, or improving real or personal property.

Are any purchases considered taxable despite the exemption certificate?

Yes, tools and equipment that are necessary for performing a job and are often considered as overhead items remain taxable. Since contractors and retailer/contractors are deemed the final consumers of these tools in their trade or business, they must pay sales tax upon purchase. This includes items like drills, hammers, saws, and wrenchs. Additionally, leased or rented construction equipment for a job is also taxable unless exempted by a Project Exemption Certificate.

Does the exemption apply to labor services?

No, the ST 28W certificate only applies to tangible personal property. Taxable labor services performed by a contractor or a retailer/contractor cannot be purchased exempt from sales tax using this certificate. Only a Project Exemption Certificate issued by the department or its authorized agent can exempt labor services from sales tax.

How does one certify their exemption with the ST 28W form?

To certify an exemption with the ST 28W form, the purchaser must complete the certificate in its entirety, including providing a valid Kansas Sales Tax Registration Number. The purchaser must also specify the description of the tangible personal property or services purchased and certify that these items or services will be used as stated for an exempt purpose. Any deviation from the stated use could result in the purchaser being liable for the sales or compensating tax.

What happens if the exempted goods are used for non-exempt purposes?

If tangible personal property or services purchased under this exemption certificate are used for purposes other than those stated or for any purposes that are not exempt from sales or compensating tax, the purchaser becomes liable for the tax on those items.

Where can more detailed information be found?

For more detailed information regarding how sales tax applies to the construction industry and the use of the ST 28W form, contractors and retailer/contractors are encouraged to consult the Policy Information Library on the Kansas Department of Revenue’s website at www.ksrevenue.org. Additional resources, including Publication KS-1510 on Kansas Compensating Use Tax, are also available on the department’s website.

Is a Project Exemption Certificate different from the ST 28W form?

Yes, a Project Exemption Certificate is different and serves a distinctive purpose. While the ST 28W form is specifically for retailer/contractors purchasing inventory for resale that is also used in their construction activities, a Project Exemption Certificate allows for the exemption of sales tax on tangible personal property and labor services used directly on a specific project for a qualifying entity. Each certificate has specific eligibility requirements and applicability.