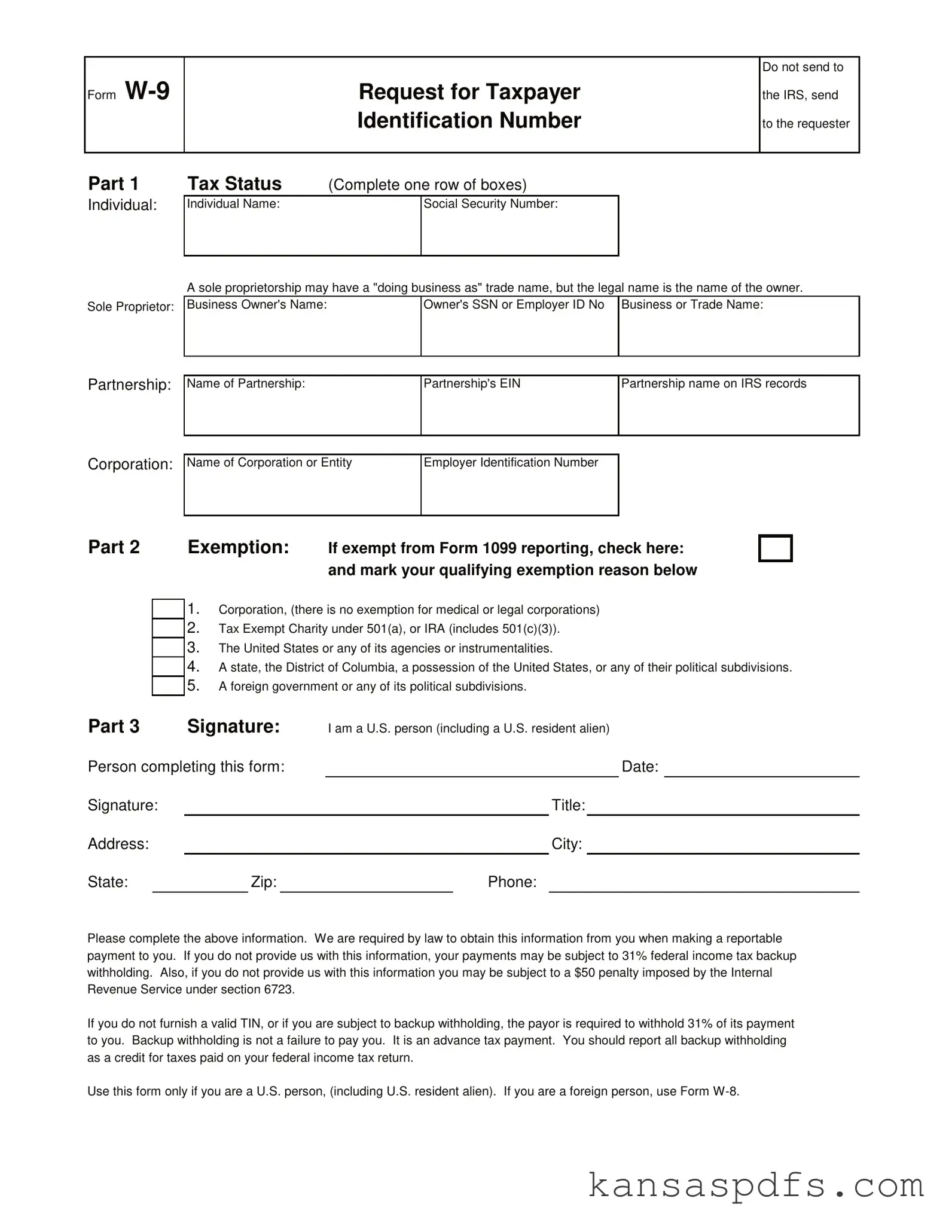

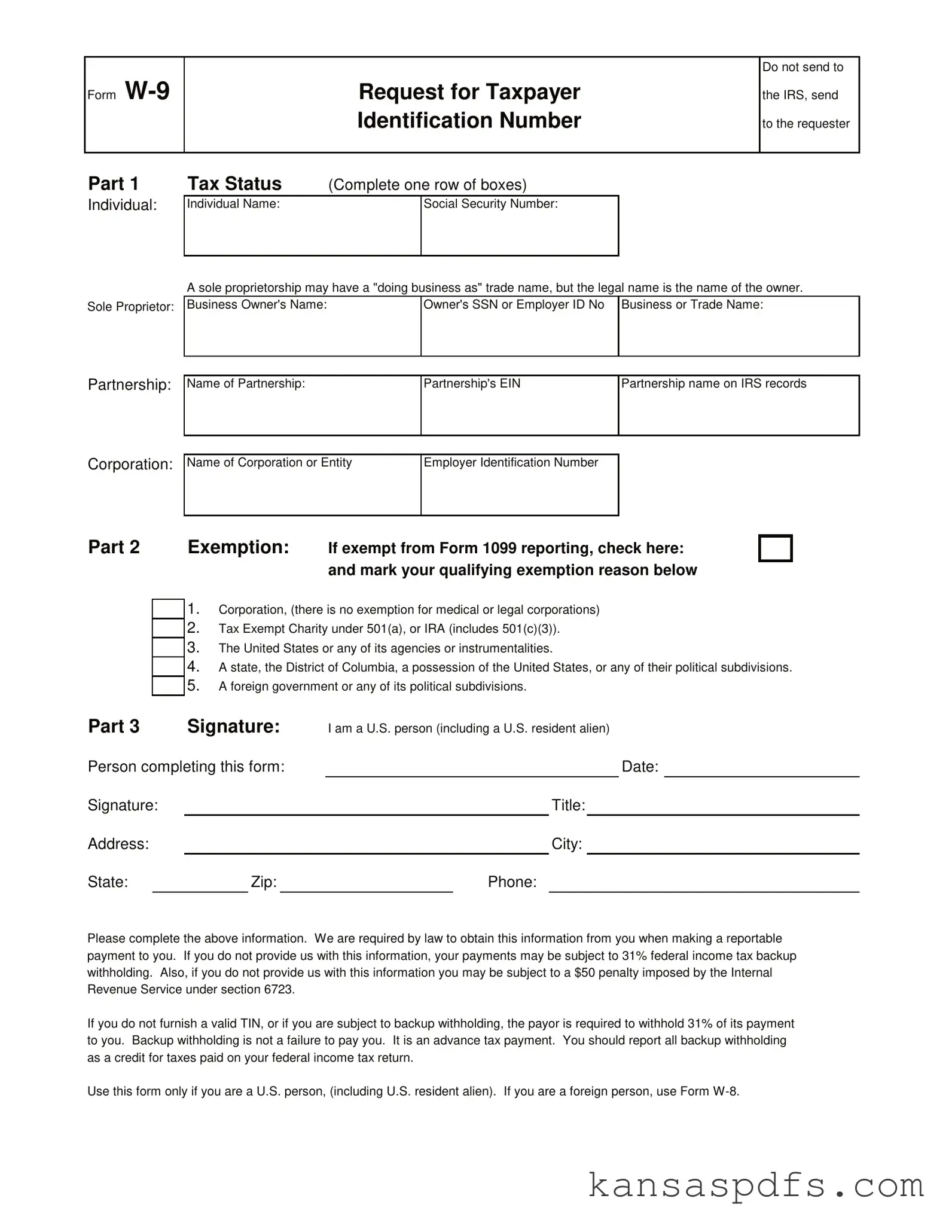

What is the Kansas W-9 Form used for?

The Kansas W-9 form is requested by entities that make payments to you as part of their obligation to report income payments and tax withholdings to the IRS. This form is used to provide your taxpayer identification number (TIN) to the entity that is requesting it, to ensure accurate reporting to the IRS and to avoid potential withholding taxes.

Who needs to complete the Kansas W-9 Form?

Any U.S. person, including a resident alien, who is receiving income, has to complete this form when requested by a payer. This includes individuals, sole proprietors, partnerships, corporations, and other entities that are involved in business transactions that result in reportable payments.

What should I do with the form once it is completed?

Do not send the completed form to the IRS. Instead, give it directly to the requester. They need this information to report payments they make to you to the IRS accurately.

Can a sole proprietorship use a business name on the Kansas W-9 Form?

Yes, a sole proprietor may use their "doing business as" (DBA) name on the form. However, the legal name of the sole proprietor (the name of the owner) must also be included along with the owner's Social Security Number (SSN) or Employer Identification Number (EIN).

What are the exemptions from Form 1099 reporting?

Some entities are exempt from Form 1099 reporting, including corporations (except medical and legal corporations), tax-exempt charities under 501(a), including 501(c)(3), the United States or any of its agencies or instrumentalities, a state, the District of Columbia, a possession of the United States or any of their political subdivisions, and foreign governments or any of its political subdivisions.

What happens if I do not provide a valid TIN?

If you do not provide a valid Taxpayer Identification Number, or if you are subject to backup withholding, the payer must withhold 31% of its payment to you as federal income tax backup withholding. Backup withholding is considered an advance tax payment.

What is the penalty for not providing the necessary information?

If you fail to provide the required information, your payments may be subject to backup withholding at a rate of 31%, and you may also face a $50 penalty imposed by the Internal Revenue Service under section 6723.

How do I report backup withholding on my tax return?

You should report any amount withheld under backup withholding as a credit for taxes paid on your federal income tax return. This ensures that you are not double-taxed on that income.

Who signs the Kansas W-9 Form?

The form must be signed by the U.S. person (including a U.S. resident alien) receiving the reportable payment. This verifies that the information provided is accurate and that you are indeed a U.S. person.

Is there an alternative form for foreign persons?

Yes, if you are a foreign person, you should not use the Kansas W-9 form. Instead, you should use Form W-8, which is specifically designed for foreign individuals and entities to provide their taxpayer information.