What is a Kansas Motor Vehicle Bill of Sale?

A Kansas Motor Vehicle Bill of Sale is a legally recognized document that records the transaction of a vehicle from the seller to the buyer within the state of Kansas. It provides proof of purchase and specifies the details of the sale, including information about the buyer, seller, and the vehicle being sold.

Why do I need a Kansas Motor Vehicle Bill of Sale?

This document serves several purposes: it protects both the buyer and the seller in case of future disputes regarding the vehicle’s condition or ownership; it might be required for tax assessment purposes; and it is necessary for the buyer to register the vehicle in their name with the Kansas Department of Revenue's Division of Vehicles.

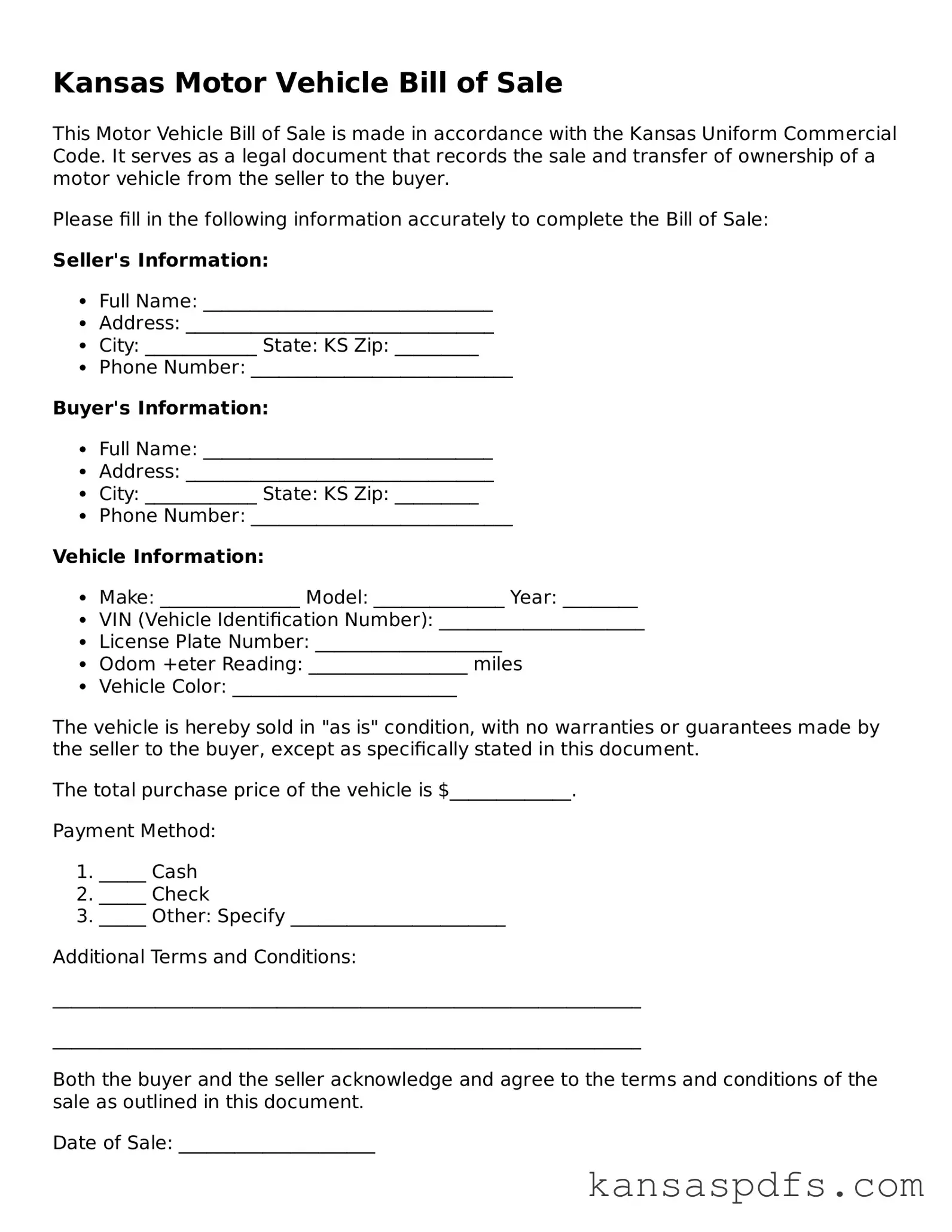

What information should be included in the Bill of Sale?

A comprehensive Kansas Motor Vehicle Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the vehicle (make, model, year, VIN), the sale price, the date of the sale, and signatures of both parties involved.

Is a notary required for a Kansas Motor Vehicle Bill of Sale?

In Kansas, notarization of a Motor Vehicle Bill of Sale is not a mandatory requirement for it to be considered valid. However, having the document notarized can add an extra layer of legal protection and authentication to the transaction.

Does the Bill of Sale need to be submitted to any Kansas state agency?

While the Kansas Motor Vehicle Bill of Sale itself does not need to be submitted to a state agency, the buyer must use it among other required documents to register the vehicle. The Kansas Department of Revenue requires the Bill of Sale for vehicle registration and titling purposes.

Can a Bill of Sale be used to release the seller from liability?

Yes, the Bill of Sale can serve as a release of liability for the seller, indicating that the vehicle's ownership has officially been transferred to the buyer. To further protect themselves, sellers should also complete a Seller's Notification of Sale, which is a separate document that notifies the state of Kansas of the change in vehicle ownership.

What if the vehicle is a gift?

If a vehicle is being transferred as a gift, a Kansas Motor Vehicle Bill of Sale may still be used to document the transaction, with the sale price listed as $0. Additionally, both parties should clearly state in the document that the vehicle is being gifted to avoid any confusion or tax implications.

Are there any specific requirements for a Kansas Motor Vehicle Bill of Sale to be considered legal?

The document needs to contain accurate information and details about the transaction and be signed by both the seller and the buyer. While notarization is not a requirement for legality, it is recommended. The information provided must accurately reflect the transaction for the Bill of Sale to be considered valid and legal.

What happens if you lose your Kansas Motor Vehicle Bill of Sale?

If the Bill of Sale is lost, it’s advisable to contact the other party involved in the transaction to obtain a copy. If that's not feasible, drafting a new Bill of Sale, to be signed by both parties again, may be necessary. Keeping a digital copy of the document can help avoid these issues.

Can a Bill of Sale be completed digitally in Kansas?

Yes, Kansas allows for digital completion and signing of a Motor Vehicle Bill of Sale. Electronic signatures are considered legal and binding in Kansas. However, when transferring the actual vehicle title and registration, physical documents may still be required by the Kansas Department of Revenue.