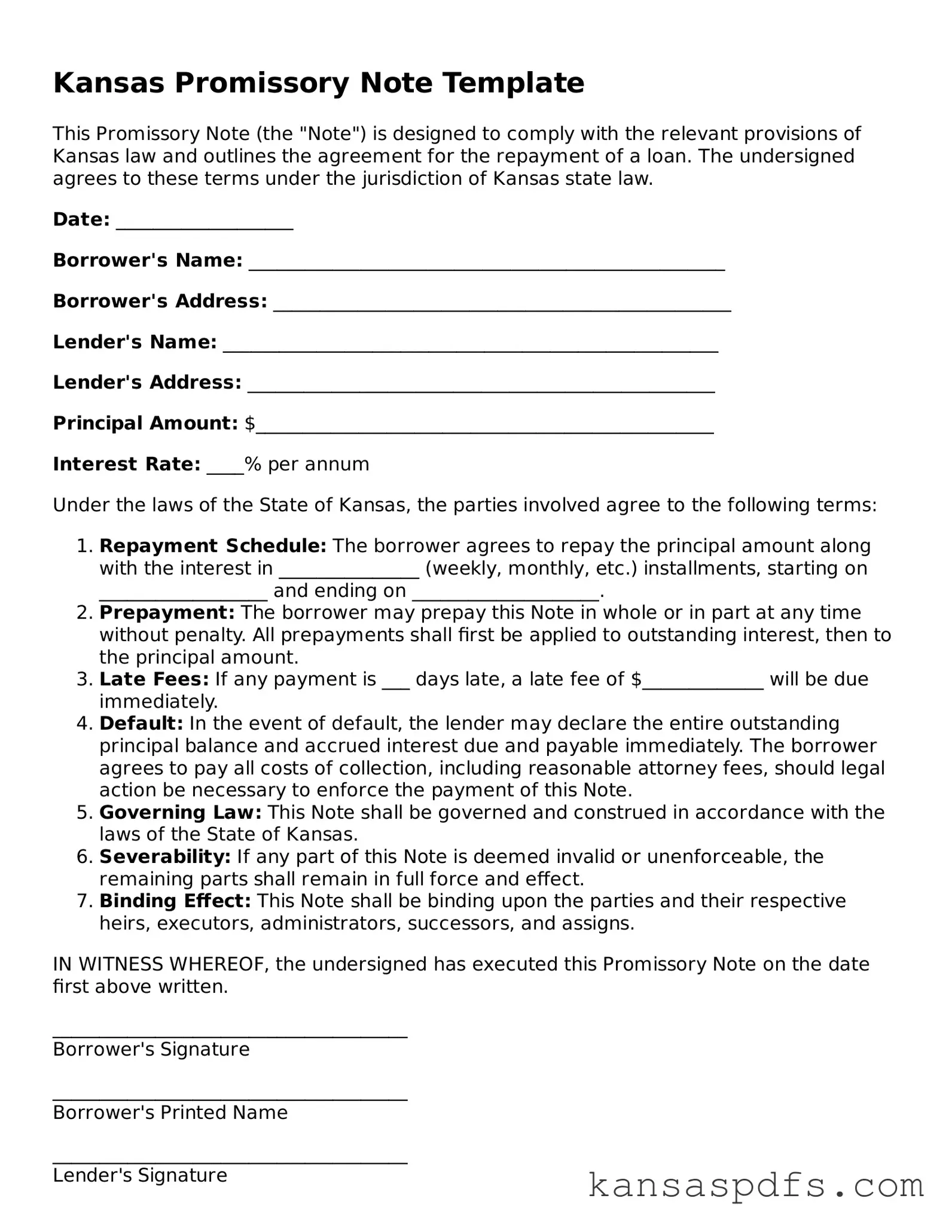

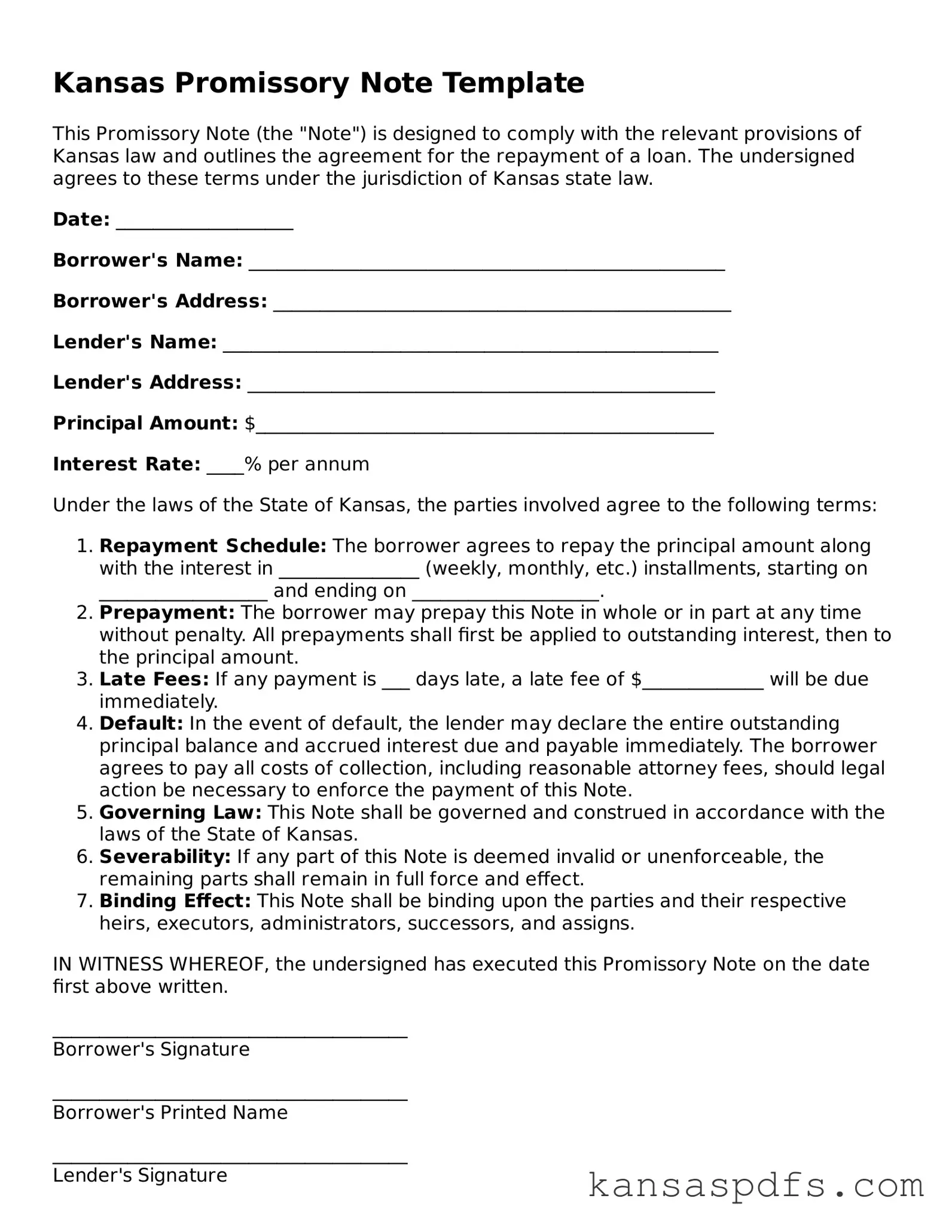

Blank Kansas Promissory Note Document

A Kansas Promissory Note form is a legal document used to outline the details of a loan between two parties in Kansas. It clearly specifies the terms of the loan, including the amount borrowed, the interest rate, and the repayment schedule, ensuring both the borrower and the lender have a clear understanding of their obligations. For those looking to secure or provide a loan in Kansas, completing a Promissory Note is a critical step.

Get My Form Now

Blank Kansas Promissory Note Document

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Promissory Note online with quick edits and instant download.