What is a Kansas Small Estate Affidavit?

A Kansas Small Estate Affidavit is a legal document used to handle the assets of a deceased individual (decedent) in Kansas whose estate does not surpass a certain value threshold, allowing for a simplified and expedited distribution process to rightful heirs without going through formal probate court proceedings.

When can a Kansas Small Estate Affidavit be used?

This affidavit can be utilized if the total value of the decedent's estate, excluding real estate and certain types of personal property, does not exceed $40,000. It allows heirs to collect assets 30 days after the decedent’s death, provided all qualifications are met.

What is the value limit for using a Kansas Small Estate Affidavit?

The value limit for the estate to qualify for a small estate affidavit in Kansas is $40,000 or less. This calculation includes only the assets that would have otherwise required probate processing, not the total value of all the decedent’s assets.

Who can file a Small Estate Affidavit in Kansas?

Legally recognized heirs or duly appointed representatives of the decedent's estate may file a Small Estate Affidavit. This includes spouses, children, parents, or other relatives who stand to inherit under Kansas's laws of intestate succession if there was no valid will.

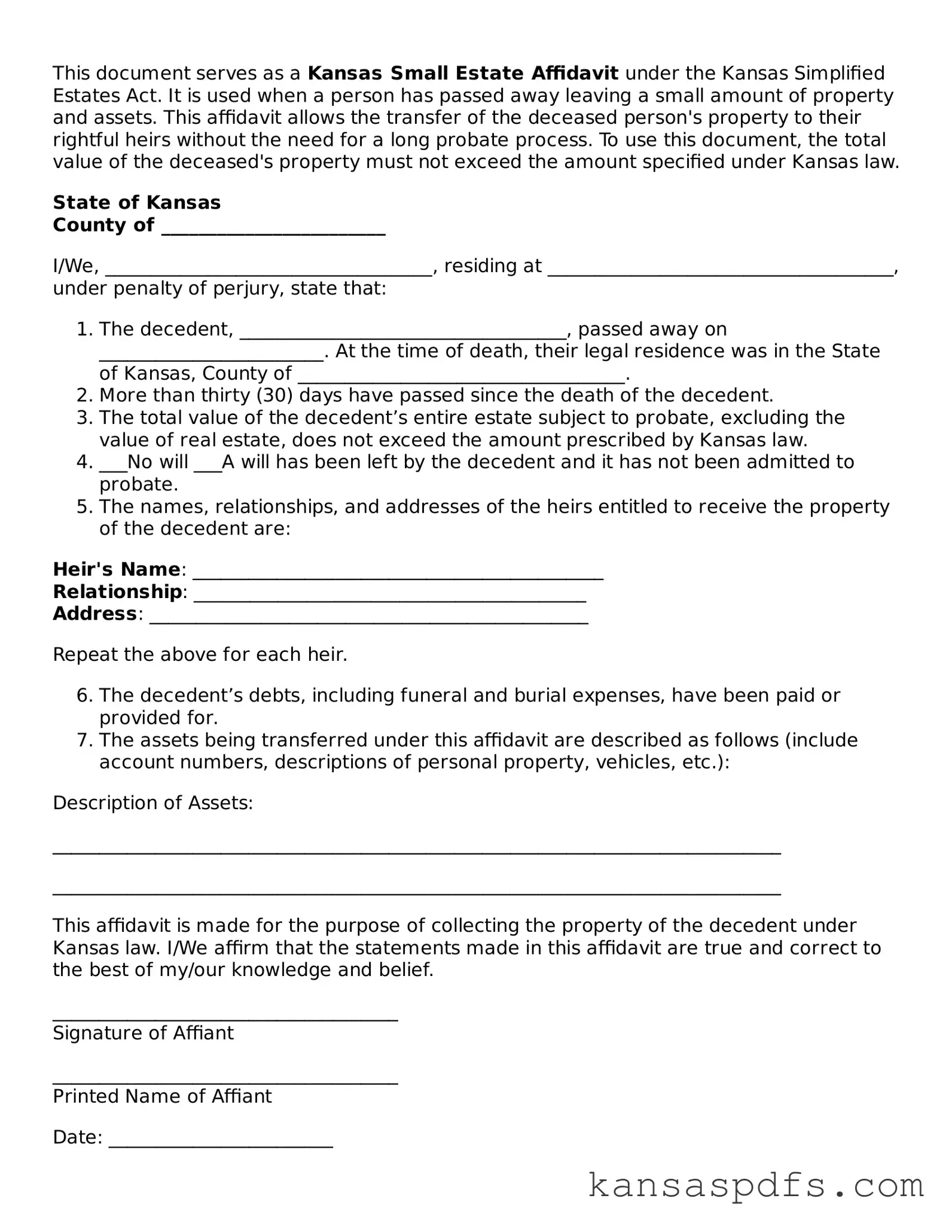

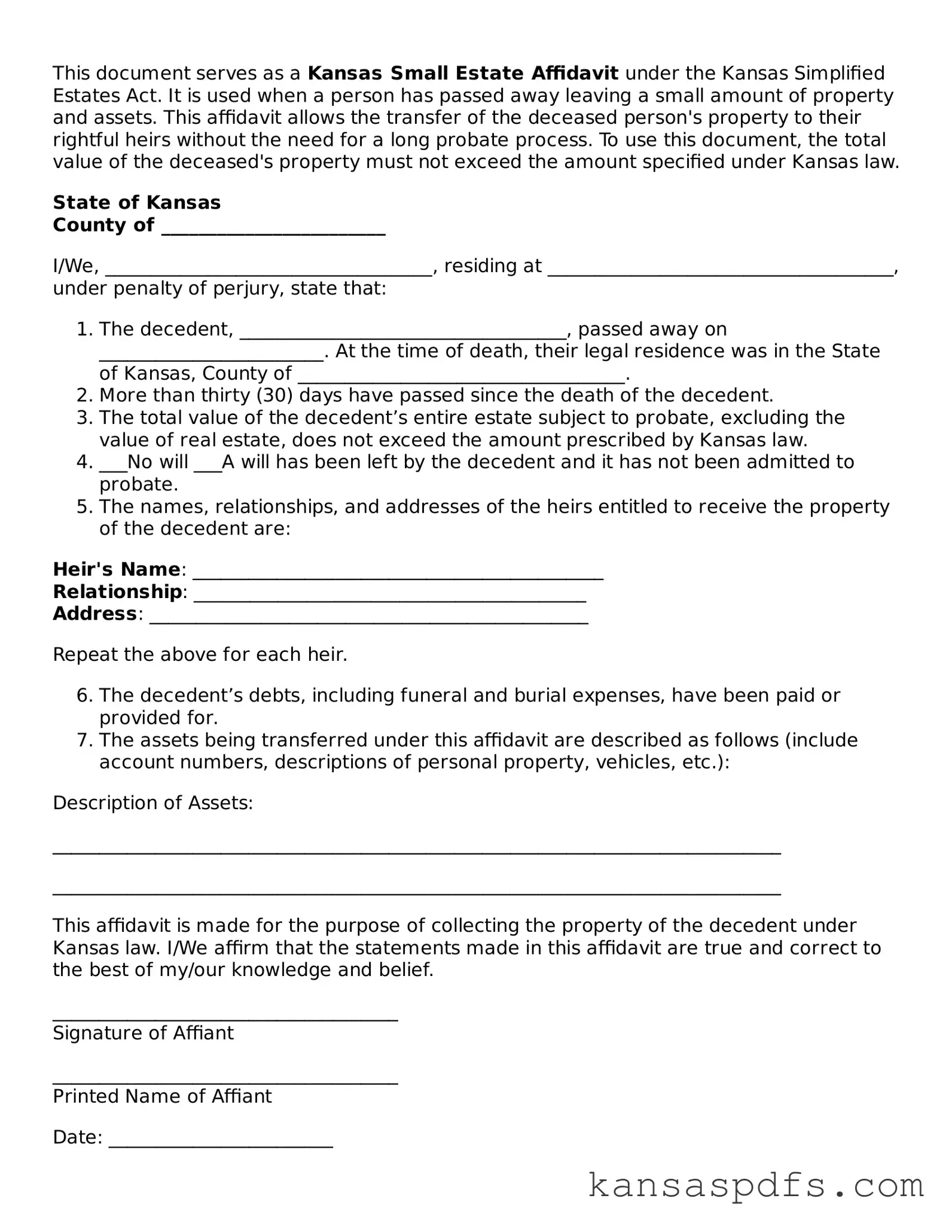

What information is needed to complete the affidavit?

The affidavit must contain detailed information about the decedent, the estate's assets, the heirs entitled to the estate, the value of the estate, and any debts owed by the estate. A thorough description of the assets and the legal names and addresses of the heirs are also required. Claimants must also affirm that the estate qualifies under the small estate threshold.

Are there any assets that cannot be transferred using the affidavit?

Yes, certain assets cannot be transferred using a Kansas Small Estate Affidavit. These typically include real estate and vehicles that are registered and titled. Instead, these types of assets may require a transfer on death (TOD) deed or a similar legal mechanism.

How is the Small Estate Affidavit filed?

In Kansas, the Small Estate Affidavit is filed with the district court in the county where the decedent resided at the time of their death or where the property of the decedent is located. The filing process involves submitting the completed affidavit along with any required supporting documentation and a filing fee, if applicable.

Is there a waiting period before filing a Kansas Small Estate Affidavit?

Yes, there is a mandatory waiting period of 30 days after the decedent’s death before the Small Estate Affidavit can be filed. This waiting period allows time for a comprehensive determination of the estate's assets and for any creditors to come forward with claims against the estate.