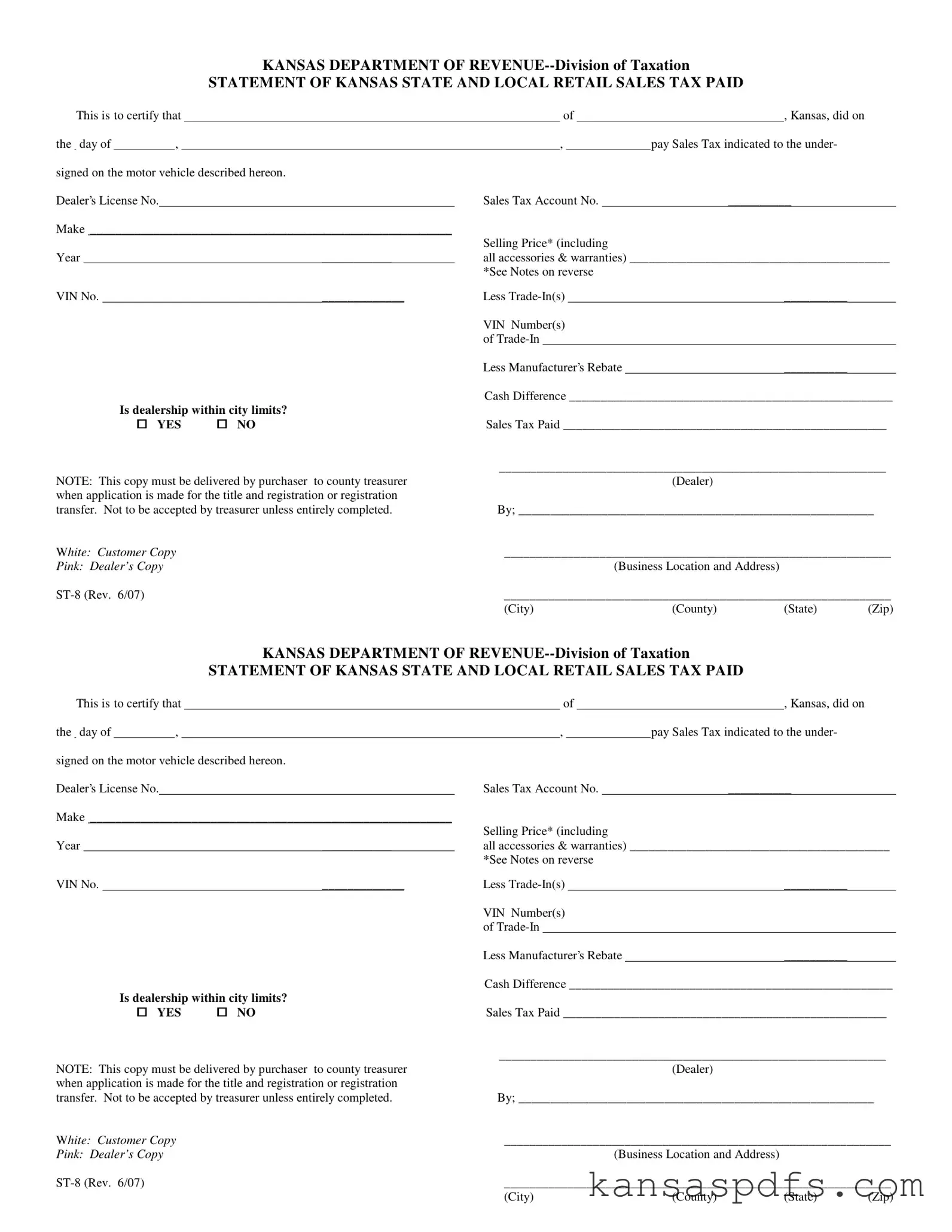

KANSAS DEPARTMENT OF REVENUE--Division of Taxation

STATEMENT OF KANSAS STATE AND LOCAL RETAIL SALES TAX PAID

This is to certify that |

|

|

|

of |

|

|

, Kansas, did on |

the day of |

|

, |

|

|

|

|

, |

|

|

|

|

|

pay Sales Tax indicated to the under- |

signed on the motor vehicle described hereon. |

|

|

|

|

|

|

|

|

|

|

Dealer’s License No. |

|

|

|

|

|

Sales Tax Account No. |

|

__________ |

Make _________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Price* (including |

|

|

Year |

___________ |

|

all accessories & warranties) _________________________________________ |

|

|

|

|

|

|

|

|

|

*See Notes on reverse |

|

|

VIN No. |

|

_____________ |

Less Trade-In(s) |

__________ |

|

|

|

|

|

|

|

|

|

VIN Number(s) |

|

|

|

|

|

|

|

|

|

|

|

|

of Trade-In |

|

|

|

|

|

|

|

|

|

|

|

|

Less Manufacturer’s Rebate |

|

__________ |

|

|

Cash Difference ___________________________________________________ |

Is dealership within city limits? |

|

|

|

|

YES |

NO |

Sales Tax Paid ___________________________________________________ |

|

|

_____________________________________________________________ |

NOTE: This copy must be delivered by purchaser to county treasurer |

|

(Dealer) |

|

|

when application is made for the title and registration or registration |

|

|

|

|

transfer. Not to be accepted by treasurer unless entirely completed. |

By; ________________________________________________________ |

White: Customer Copy |

|

_____________________________________________________________ |

Pink: Dealer’s Copy |

|

|

(Business Location and Address) |

|

|

ST-8 (Rev. 6/07) |

|

_____________________________________________________________ |

|

|

(City) |

(County) |

(State) |

(Zip) |

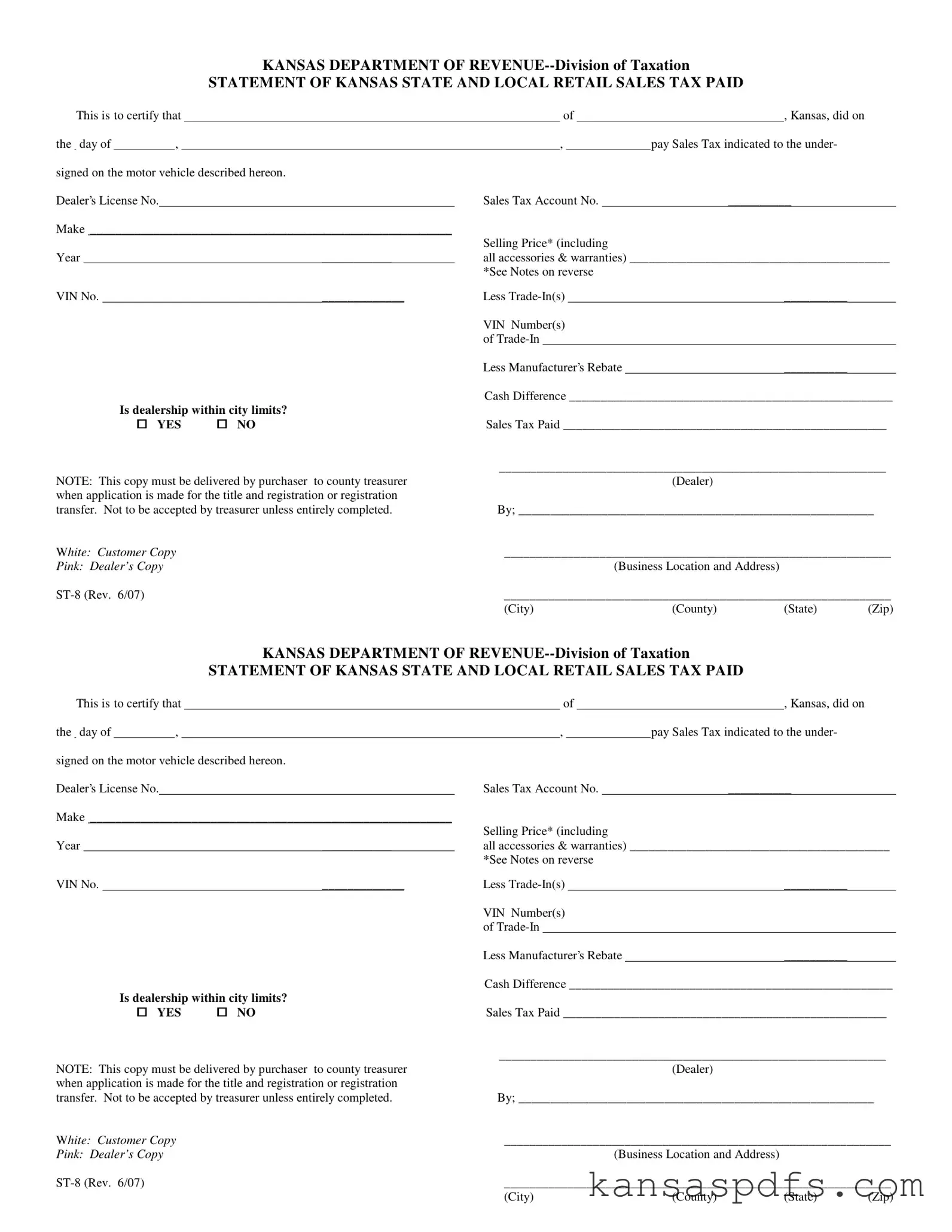

KANSAS DEPARTMENT OF REVENUE--Division of Taxation

STATEMENT OF KANSAS STATE AND LOCAL RETAIL SALES TAX PAID

This is to certify that |

|

of |

|

|

, Kansas, did on |

the day of |

|

, |

|

|

, |

|

|

pay Sales Tax indicated to the under- |

signed on the motor vehicle described hereon.

Dealer’s License No. |

|

|

Sales Tax Account No. |

|

__________ |

Make _________________________________________________________ |

|

|

|

|

|

|

|

|

|

|

Selling Price* (including |

|

Year |

___________ |

|

all accessories & warranties) _________________________________________ |

|

|

|

|

|

*See Notes on reverse |

|

VIN No. |

|

_____________ |

Less Trade-In(s) |

__________ |

|

|

|

|

|

VIN Number(s) |

|

|

|

|

|

|

|

of Trade-In |

|

|

|

|

|

|

|

Less Manufacturer’s Rebate |

__________ |

|

|

Cash Difference ___________________________________________________ |

Is dealership within city limits? |

|

|

|

|

YES |

NO |

Sales Tax Paid ___________________________________________________ |

|

|

_____________________________________________________________ |

NOTE: This copy must be delivered by purchaser to county treasurer |

|

(Dealer) |

|

|

when application is made for the title and registration or registration |

|

|

|

|

transfer. Not to be accepted by treasurer unless entirely completed. |

By; ________________________________________________________ |

White: Customer Copy |

|

_____________________________________________________________ |

Pink: Dealer’s Copy |

|

|

(Business Location and Address) |

|

|

ST-8 (Rev. 6/07) |

|

_____________________________________________________________ |

|

|

(City) |

(County) |

(State) |

(Zip) |

NOTICE

This form should be sent immediately to Dealer Licensing, P.O. Box 2369, Topeka, Kansas 66601-2369. Please send a new pad of Form ST-8.

Sales Tax Account No. |

|

|

|

|

Dealer No. |

|

|

|

|

|

|

(Dealer) |

|

|

|

|

|

|

(Street) |

|

|

, KS |

|

|

(City) |

|

|

(Zip Code) |

To order more ST-8 booklets, please fax your order to:

Dealer Licensing 785-296-5854

NOTICE

This form should be sent immediately to Dealer Licensing, P.O. Box 2369,Topeka, Kansas 66601-2369.

Please send a new pad of Form ST-8. |

|

|

|

|

Sales Tax Account No. |

|

|

|

Dealer No. |

|

|

|

|

|

|

|

(Dealer) |

|

|

|

|

|

|

|

|

|

|

|

(Street) |

|

|

|

|

|

|

, KS |

|

|

(City) |

|

(Zip Code) |

To order more ST-8 booklets, please fax your order to:

Dealer Licensing 785-296-5854

NOTICE

Carbonless type paper.

Please insert cover flap between sets before using.

NOTICE

Carbonless type paper.

Please insert cover flap between sets before using.

NOTES

“Selling Price” is the total amount of consideration, including cash, credit, property and services, for which the motor vehicle is sold, leased or rented whether received in money or otherwise. “Selling Price” includes the base selling price of the motor vehicle, all accessories, installation charges, repair charges, any transportation/destination/delivery costs, vehicle preparation fees, VIN Etching, undercoating protection, administrative and/or handling fees, all charges for the federal gas guzzlers tax, and effective July 1, 2007, all warranties, maintenance or service agreements.

The effect of including warranties, maintenance or service agreements in the selling price is that the sale of warranties to nonresidents of the state of Kansas, who will not register the motor vehicle in Kansas and who will remove the motor vehicle from the state of Kansas within 10 days of the date of purchase, is that the warranty, maintenance or service agreement, similar to the motor vehicle itself, is not be subject to Kansas retailers’ sales tax. Additionally, trade-in allowances will be allowed against the value of existing warranties when trading motor vehicles.

The following are not to be included in the “Selling Price”: interest, financing or carrying charges, GAP – Guaranteed Auto Protection Insurance, registration fees including title fees, federal excise tax on trucks and trailers, mobility enhancing equipment, and Kansas Tire Excise tax when these are separately stated on the invoice. Commencing on July 1, 2006 and ending on June 30, 2009 “Selling Price” does not include cash rebates granted by a manufacturer to a purchaser or lessee of a NEW motor vehicle when paid directly to the dealer as a result of the original sale.

NOTES

“Selling Price” is the total amount of consideration, including cash, credit, property and services, for which the motor vehicle is sold, leased or rented whether received in money or otherwise. “Selling Price” includes the base selling price of the motor vehicle, all accessories, installation charges, repair charges, any transportation/destination/delivery costs, vehicle preparation fees, VIN Etching, undercoating protection, administrative and/or handling fees, all charges for the federal gas guzzlers tax, and effective July 1, 2007, all warranties, maintenance or service agreements.

The effect of including warranties, maintenance or service agreements in the selling price is that the sale of warranties to nonresidents of the state of Kansas, who will not register the motor vehicle in Kansas and who will remove the motor vehicle from the state of Kansas within 10 days of the date of purchase, is that the warranty, maintenance or service agreement, similar to the motor vehicle itself, is not be subject to Kansas retailers’ sales tax. Additionally, trade-in allowances will be allowed against the value of existing warranties when trading motor vehicles.

The following are not to be included in the “Selling Price”: interest, financing or carrying charges, GAP – Guaranteed Auto Protection Insurance, registration fees including title fees, federal excise tax on trucks and trailers, mobility enhancing equipment, and Kansas Tire Excise tax when these are separately stated on the invoice. Commencing on July 1, 2006 and ending on June 30, 2009 “Selling Price” does not include cash rebates granted by a manufacturer to a purchaser or lessee of a NEW motor vehicle when paid directly to the dealer as a result of the original sale.