What is a Kansas Tractor Bill of Sale form?

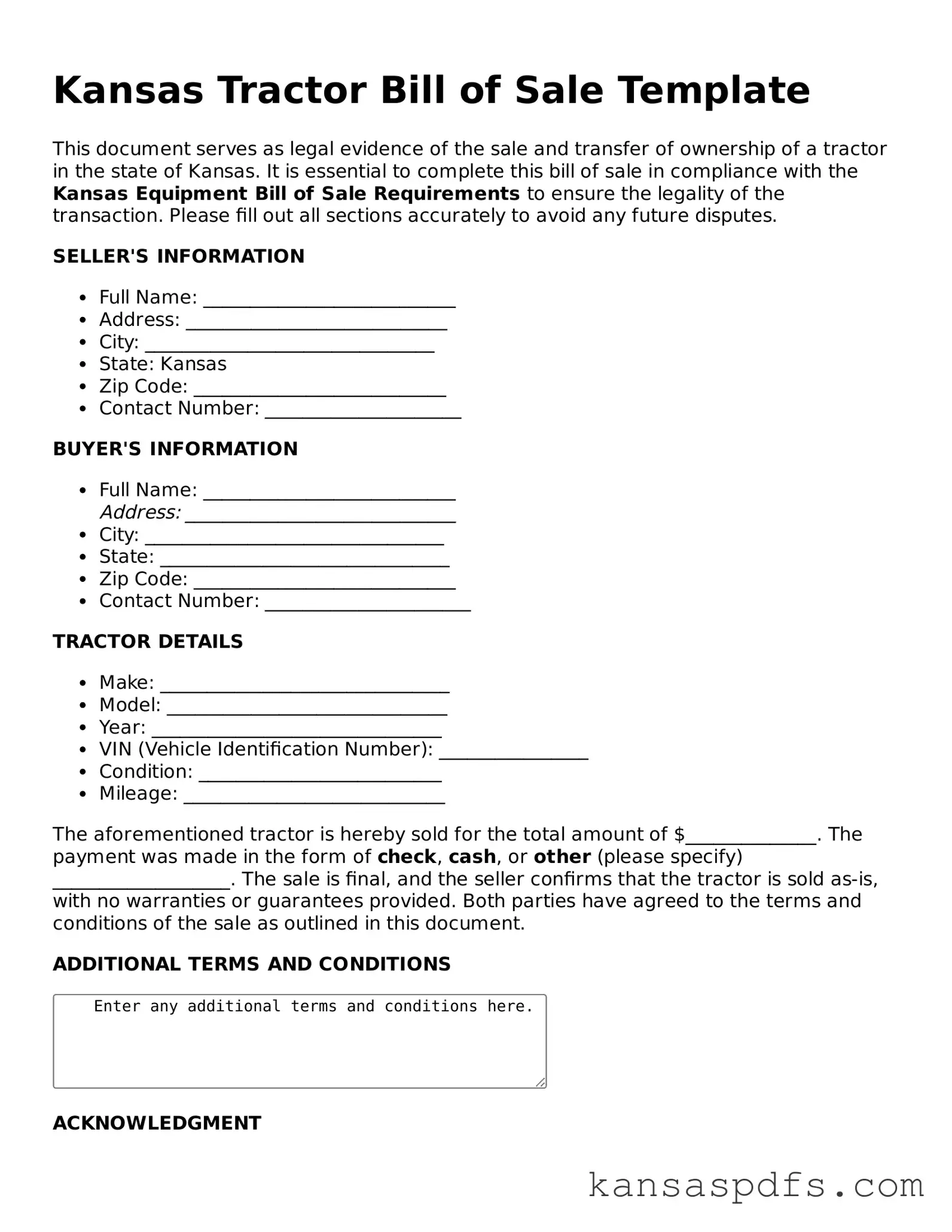

A Kansas Tractor Bill of Sale form is a legal document that records the sale of a tractor from one party, the seller, to another, the buyer, within the state of Kansas. This form serves as proof of purchase and documents the transfer of ownership. It often includes details such as the make, model, year, and identification number of the tractor, as well as personal information about the buyer and seller.

Is a Kansas Tractor Bill of Sale legally required?

In Kansas, a Bill of Sale is not strictly required for the sale of a tractor but is highly recommended. It serves as a legal record of the transaction and can be crucial for the buyer's property tax assessments or any future disputes regarding ownership. Though not mandated by law, its importance cannot be overstressed for the protection it provides to both parties involved.

What information should be included in the form?

A comprehensive Kansas Tractor Bill of Sale should include the name and address of both the seller and the buyer, the sale date, the sale amount, detailed information about the tractor (including make, model, year, and serial number), and any additional conditions of the sale. Signatures of both parties, and occasionally a notary public, are also essential to validate the form.

Do I need to have the form notarized?

While notarization of the Kansas Tractor Bill of Sale is not a requirement by Kansas law, having the document notarized can add a layer of legal protection. It ensures that the signatures on the form are verified, reducing the potential for fraud. This can be particularly beneficial in settling any future disputes over the transaction or the tractor's ownership.

Can I create a Kansas Tractor Bill of Sale form myself?

Yes, it is possible to create a Kansas Tractor Bill of Sale form yourself. Ensure that all the necessary information is included and that the form is clear and easy to understand. However, to guarantee that the document complies with all legal requirements and effectively protects your rights, you might consider obtaining a template from a reputable source or seeking advice from a legal professional.

What should I do with the form after the sale is complete?

After the sale is complete, both the buyer and the seller should keep a copy of the Kansas Tractor Bill of Sale for their records. This document will serve as evidence of the transfer of ownership and may be required for tax purposes or to resolve any future disputes that arise regarding the tractor. It is recommended to keep the document in a safe, accessible place for as long as the tractor is in possession.