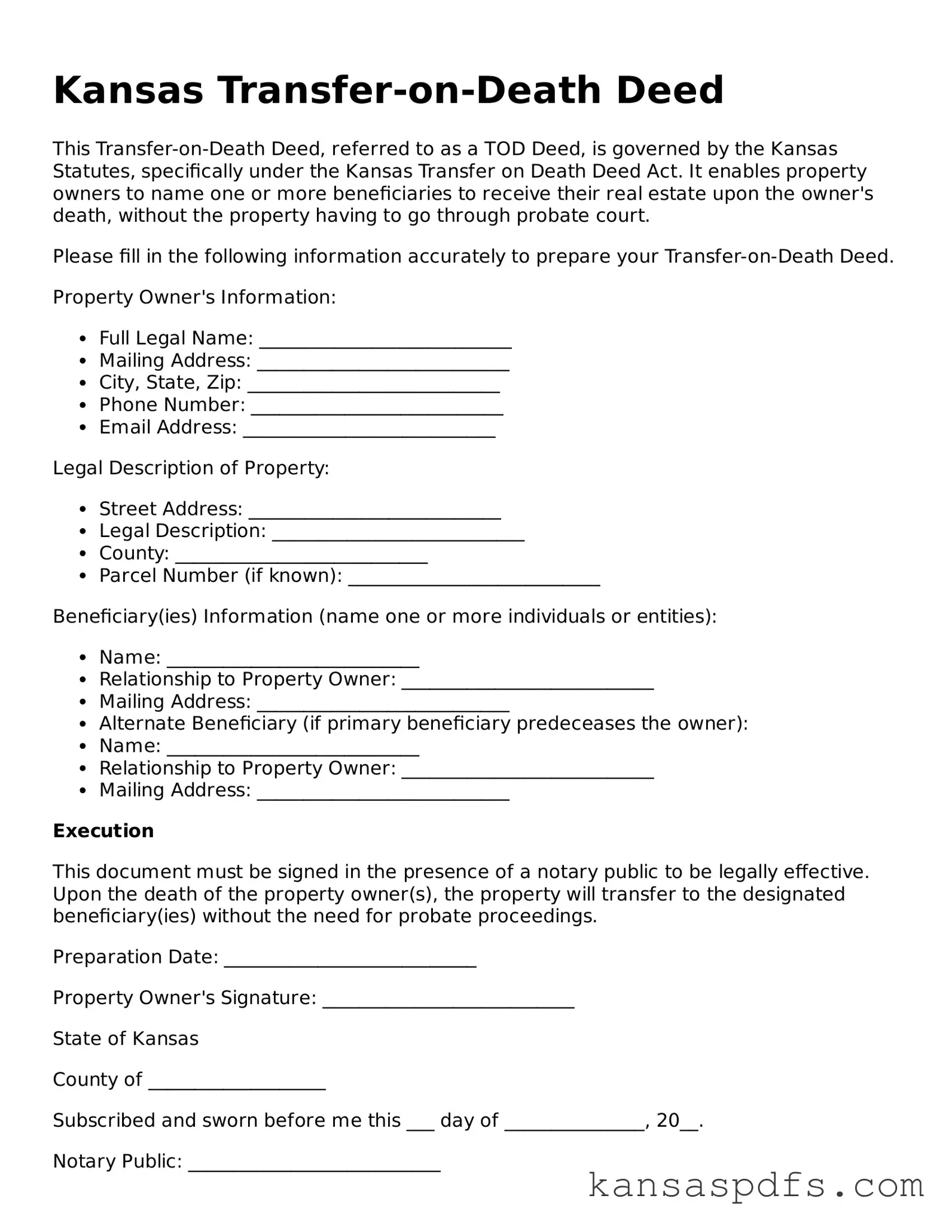

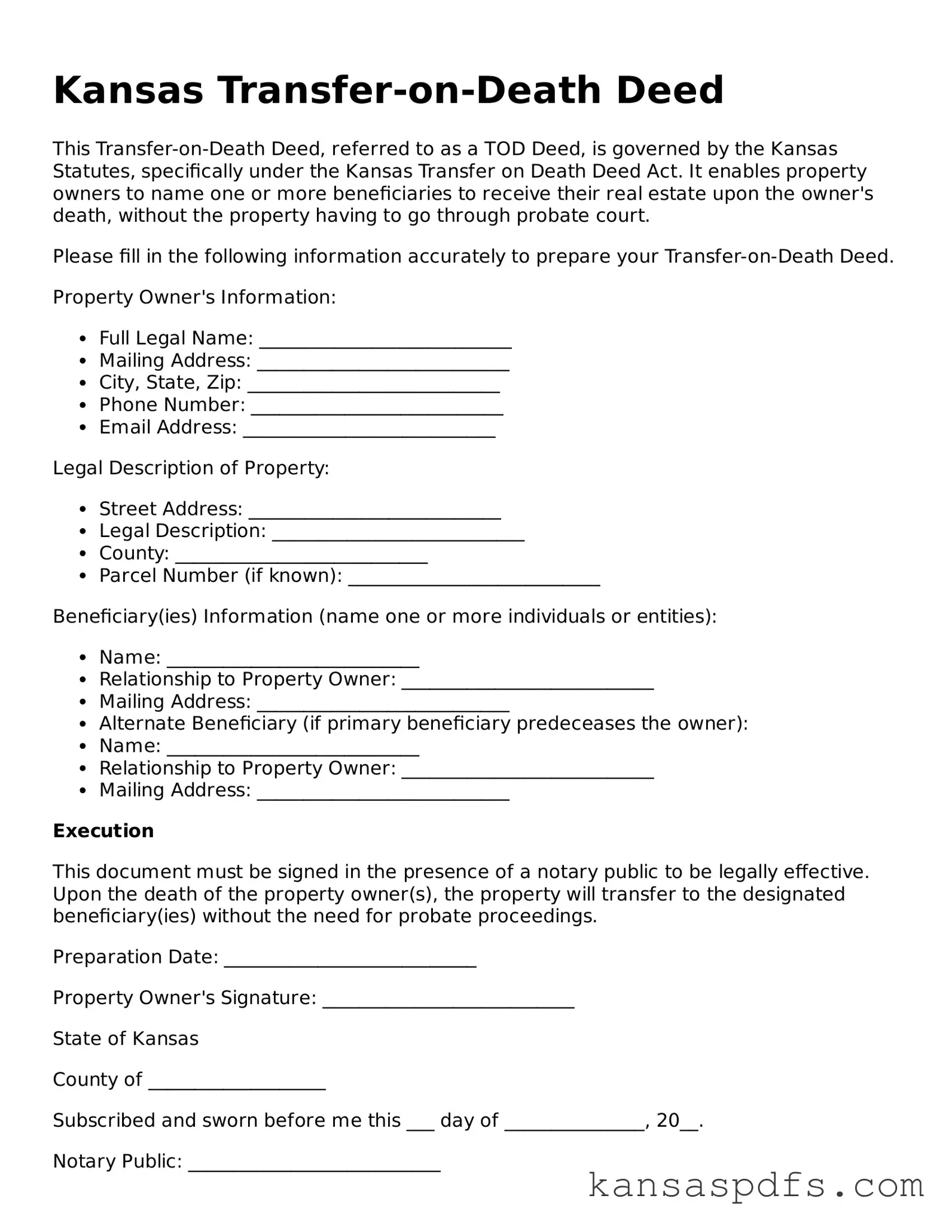

Blank Kansas Transfer-on-Death Deed Document

The Kansas Transfer-on-Death Deed form serves as a legal document that allows property owners in Kansas to pass their real estate to a beneficiary upon their death without the need for probate court proceedings. It creates a non-probate mechanism for the transfer of real property, ensuring a smoother transition to the designated beneficiary. For those interested in utilizing this estate planning tool, detailed guidance on properly filling out the form is just a click away.

Get My Form Now

Blank Kansas Transfer-on-Death Deed Document

Get My Form Now

Get My Form Now

or

Free PDF

Finish this form without wasting time

Finish your Transfer-on-Death Deed online with quick edits and instant download.